Credit cards have a reputation for encouraging people, like me, to spend money with confidence, especially when enticing offers are presented. Credit cards have helped me personally in many ways, from building a good credit history and enjoying cashback rewards.

The plastic credit cards that we often use have not been around since forever. So let us look at what a credit card is and how it came to be.

In this article, I’ll give you a brief overview of the first credit card that was created and how the credit card creator came up with the idea. Read on for more details.

- A Brief History Of Credit Cards

- The First Credit Card

- A Brief Timeline Review Of Diners Club

- How Credit Cards Have Evolved

A Brief History Of Credit Cards

Before giving you a brief history of credit cards, let me explain what a credit card is and how it differs from other types of bank cards. So, a credit card is a payment card that is provided to cardholders to allow them to pay for products and services based on their accumulated debt.

The card issuer opens a running credit for the cardholder and provides a line of credit from which the user can the loaned cash to pay a retailer for a product or service. This card differs from a charge card in that the amount on a charge card must be repaid monthly or at the end of each statement cycle.

The origins of the credit card may be traced back to the 1800s in America. Businesses used credit pennies and charge discs to offer credit to local farmers during the colonial period, permitting them to postpone paying their debts until they reaped their harvest or liquidated their livestock.

Even though it was still inconvenient, a block of mud with stamps from both cultures beat the tons of copper each civilization would’ve had to break down to make the coins of the time.

Why Did Credit Card Exist?

As per Jonathan Kenoyer, a historian, the idea of employing a worthless item to symbolize financial operations stretches back 5,000 years, when native Americans traded with the Harappan civilization using clay tablets. A few retail shops and oil businesses in the United States went one step further in the early 1900s.

By producing their own customized cards, they became the forerunners of today’s store cards. The Charg-It card, created by a Brooklyn banker called John Biggins in 1946, was the first bank-issued charge card. In what became known as the closed-loop method, Charg-It sales were transmitted to Biggins’ bank.

They acted as a middleman, reimbursing the vendor and collecting money from the consumer. Transactions could only be done locally, and bank clients could only obtain a Charg-It card. Franklin National Bank in New York followed suit five years later, offering its first credit card to its loan clients.

The First Credit Card

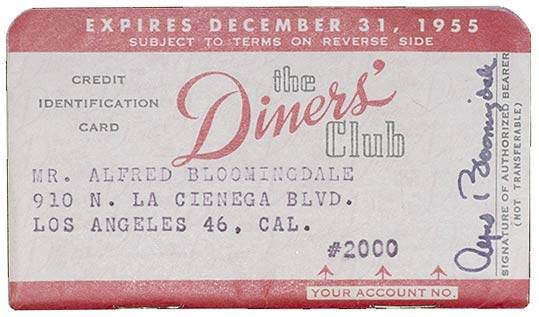

A year before, the Diners Club Card was established when a client named Frank McNamara lost his purse while at a business lunch at Major’s Cabin Grill in New York. In 1950, in the Majors Cabin Grill restaurant in New York City, the concept for Diners Club was born.

Frank McNamara, the co-founder of Diners Club, was meeting with clients when he discovered he had forgotten his wallet in another outfit. His wife picked up the price, and McNamara considered getting a multifunctional charge card to avoid future embarrassments. Fast-forward by the end of 1950; the Diners Club had grown to 20,000 members by the end of 1951.

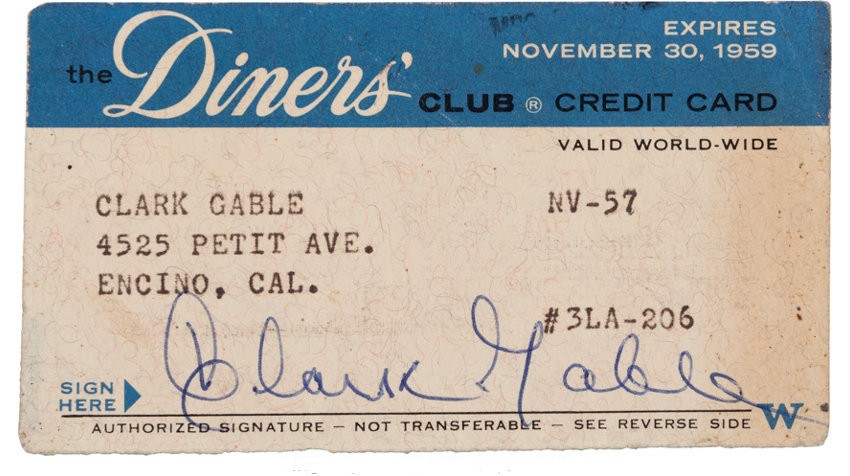

From there, it had grown to 42,000. At the time, the firm charged 7% to participating businesses and billed cardholders $5 each year. McNamara sold his Diners Club stock to his partners for $200,000 in 1952. Diners Club issued its first plastic card in 1961, and by the mid-1960s, the company had 1.3 million members.

Banks that provided revolving credit cards, such as Bank of America’s Bank Americard and Interbank Master Charge, competed with Diners Club at the end of the 1960s. The American Oil Company, or Amoco, began issuing its own co-branded Diners Club cards called American Torch Club in 1968, while Sun Oil Company began issuing its own Sun Diners Club Card in 1977.

How It Works

Before this, the Diners Club Card was mostly used for leisure and entertainment. The business also claimed to be the first to issue a credit card that was widely accepted. Diners Club was legally a charge card even though transactions were made on credit.

However, in today’s time, the Diners Club Card has progressed to become one of the most popular credit cards. As a cardholder, I may use the card to buy local items and take advantage of other excellent offers in the area. I may also use any of the more than 1,000 Diners Club airport lounges across the world.

When it comes to business, I can use the perks of this card to meet various requirements. Diners Club Card gives me access to a wide range of commercial credit card and payment options, as well as powerful expenditure management and analysis capabilities.

A Brief Timeline Review Of Diners Club

Diners Club, as previously said, became the world’s finest multifunctional charge card in 1950. The card reaches its pinnacle in 1951, with 42,000 members as acceptance spreads to major US cities.

Companies in the United Kingdom, Canada, and Mexico started accepting the card making it the first internationally accepted card. In 1958, the business launched its first big broadcast ad campaign as a partner of the New York Giants American Football team.

Diners Club also joins the travel industry during this year, when travel companies in major cities agree to accept the card for the airline, steamer, and cruise ticket purchases. During the Floyd Patterson vs. Roy Harris heavyweight title fight, Diners Club cards were used to charge more than a quarter of the $200,000 spent by fans that night.

In the year 1969, Diners Club becomes Russia’s first credit card. Fast forward to today, when Diners Club International unveils its new global website, giving members access to more than 800 lounges across the world.

How’s Diners Club Today?

Diners Club Card celebrated its 70th anniversary in 2020. Even though corporate Diners Club cards are still granted, I cannot qualify for a Diners Club card as an individual in the United States. Other good travel credit cards that give similar benefits and perks as Diners Club cards are available to me.

Diners Club cards offered benefits such as airline frequent flyer miles, vacations, and goods. However, the cards were also well-known for providing access to airport lounges and other travel-related advantages.

For company owners, similar cards were offered in two types: charge cards and credit cards. There was no possibility to apply for professional cards online as of March 2021.

How Credit Cards Have Evolved

With the passage of time, monetary transactions technology has become increasingly sophisticated. The manual imprinter, sometimes known as a zip-zap device or knuckle-buster, was among the first credit card verification “technologies” utilized by retailers.

Card approval and validation were not components of executing a credit card transaction when manual card imprinters were popular. Instead, Mastercard and Visa released a booklet with a list of all the credit card information that had been revoked or were past due, which retailers could check before confirming transactions.

Telephone authorization was established as a means to assess a customer’s credit line and simplify a transaction when more customers began to use credit cards, and transaction amounts got greater.

Merchants could still use the manual imprinter to record cardholder information, but they could also contact the phone number on the back of the card to check funds availability.

Benefits Of Using Most Credit Cards

Although having a credit card is not for everyone, many people, including myself, aspire to have one. However, before applying for any type of credit card, I recommend doing some research.

One of the advantages of having a credit card is that it teaches me how to use it responsibly. I don’t need to hear about other people’s credit card horror stories. It all comes down to how liable I am with my credit card purchases at the end of the day.

I can also monitor my credit card bill and transactions, ensuring that I do not over my credit limit. Finally, with today’s millions of internet stores, I can use a credit card to make purchases without having to visit the store’s physical location.

The Bottom Line

The history of credit cards traces back to 1950, when Diners Club began to launch its services. However, though most credit cards today seem to be the best of their times, it’s always recommended to research before applying.

I suggest doing a background check on the company. This way, I can avoid being charged too much. But, I would also advise everyone to be responsible when handling and managing their spending, especially when you already have a credit card in your pocket.