I don’t exactly have the perfect credit score out there. At times, I often find myself even being rejected for credit card applications at different types of banks with their strict requirements. Fortunately, I discovered that Capital One offers different credit cards for just about everyone.

From new credit card users, and credit-builders, to rewards fans, Capital One credit cards provide various privileges for a variety of needs. With its versatile selection, I think it’s quite easy to see why many people want to get in on what the financial institution can offer.

For those who are interested in applying for a Capital One Credit Card, let me tell you about the application process and its requirements. I will also let you in on what the card has to offer and how to manage the card as well. Read through this article to know more.

- Learn More About Capital One Credit Cards

- Features and Benefits of a Capital One Credit Card

- Applying for a Capital One Credit Card

- Understanding Interest and Charges for Capital One Credit Cards

- How I Manage My Capital One Credit Card

Learn More About Capital One Credit Cards

Capital One offers a comprehensive selection of credit cards for all types of customers. From those who want cash back rewards to those interested in building credit, there’s a Capital One credit card for everyone.

All powered by Mastercard, the range of credit cards offered by Capital One caters to those with varying needs and interests.

Depending on what I choose, I can get cashback on everyday purchases, travel rewards, discounts on dining and entertainment, for students, and many others.

Capital One credit cards are divided into four main categories of credit status, which are Building, Fair, Good, and Excellent. The offers and available credit cards, as well as the annual fee and interest rates, vary accordingly depending on the card I choose and the category it falls under.

Different Credit Cards for Everyone

I have mentioned that Capital One brings a great selection of credit products closer to its customers. These include the SavorOne Rewards for users who want cash back on dining and entertainment and the QuicksilverOne Rewards for those who want to get unlimited 1.5 percent cashback on purchases.

VentureOne Rewards for Good Credit is best for people who want to get miles for every dollar they spend on their buys.

Lastly, Capital One offers a dedicated credit builder card called the Platinum Secured card which is designed for people who have less-than-perfect credit scores, including me.

Features and Benefits of a Capital One Credit Card

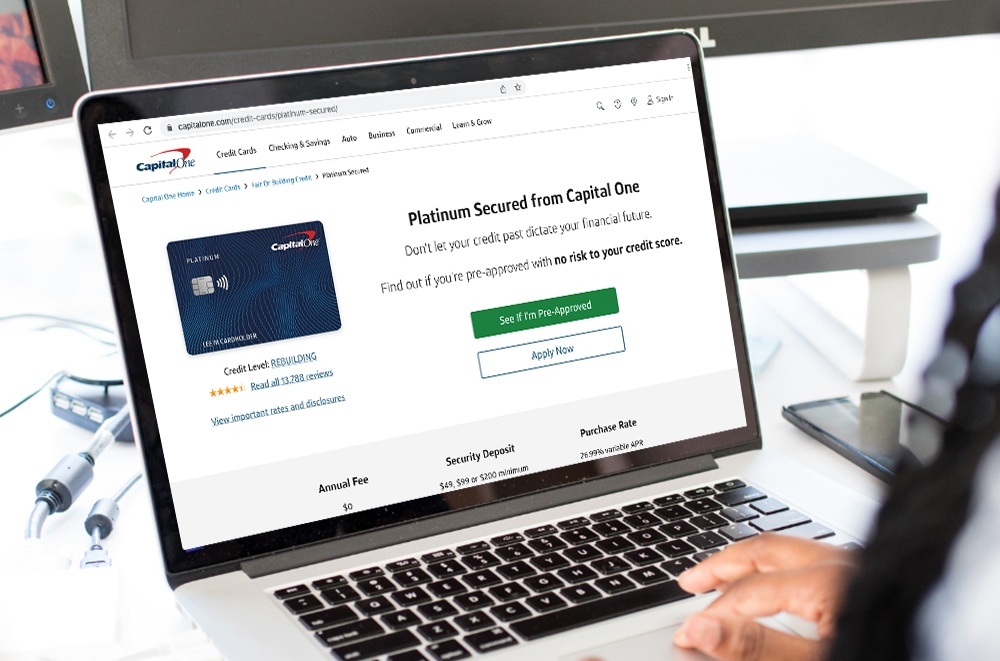

To fully understand the range of benefits that a Capital One Credit Card extends, I will be focusing on the Platinum Secured credit card. What made this quite appealing is that it comes with no annual fee. Moreover, the purchase APR is at a competitive rate of 26.99 percent.

In addition to this, there are no hidden fees when using this card. This Capital One credit card offers excellent flexibility that meets my needs. I have control over my desired due date, allowing me to find one that suits my preference and budget at the same time.

It’s worth noting that I will be able to get back my security deposit and even have the chance to upgrade to an unsecured Platinum credit card provided I am responsible for my use and repayments every month. In line with this, I will also be automatically considered for a higher credit limit in just six months.

Another highlight that comes with applying for this particular credit card is that the more I deposit, the more chances I have of being able to increase my credit limit as well. I can also get pre-approved for this card without making a dent or affecting my credit score.

Safety and Security at Every Turn

Located under the Fair or Building credit category, this credit card works by making me deposit a refundable amount in order to be allowed to open an account. This will serve as my security deposit. I have the option to choose how much I’ll be depositing from $49, $99, or $200.

Since I am talking about security, I feel good knowing that Capital One will review my account and can raise my credit line if I stay responsible with my credit card use and make payments on time.

My credit score is likewise monitored and I can get unlimited access to these via CreditWise, giving me the peace of mind I need. The bank also gives timely alerts and reminders through text and email about suspicious activities, charges, and the like.

Applying for a Capital One Credit Card

I have mentioned that I can get pre-approval for a Capital One credit card prior to doing a hard application which can affect my credit score. Thankfully, I can get easily started with the pre-approval by answering a series of questions on the Capital One website.

The pre-approval questionnaire is essential to see what cards and offers I’m eligible for without having an impact on my credit. Plus, it also shortens the overall application. The pre-approval questionnaire required me to provide my name, residential address, email address, phone number, date of birth, and Social Security number.

In addition to these details, I also gave details on my employment such as my total annual income, as well as my monthly rent or mortgage. Once I have filled out the necessary details, the website will give options that fit my current standing and credentials.

To complete my application, I only had to choose what credit card I’d like to apply for. Then, I was asked to confirm my phone number, Social Security number, employment status, occupation, and citizenship. If approved, I can be granted an initial credit line of up to $1,000.

Eligibility Requirements and Qualifications

In order to qualify for this card, you must be a resident of the United States and bear a valid address in the country. You should also be at least 18 years of age and have a valid Social Security number or Individual Taxpayer Identification Number.

Having a savings or checking account is likewise important to be considered for a Capital One credit card. In addition to this, you should not have applied for a Capital One credit card three or more times in the last 45 days. In general, you should have good financial standing and have not declared bankruptcy.

Your monthly income should not exceed my rent or mortgage by $425. Capital One may also require you to present proof of income, address, and identification, as well as your credit score. The bank may evaluate you based on these requirements.

Understanding Interest and Charges for Capital One Credit Cards

Learning about the different fees and charges that come with a credit card is vital to me.

This allows me to gauge whether or not I am capable of paying back the amount I borrowed on time and in full, alongside any interests or charges that may be levied on my purchases and transactions.

For those who are interested in applying for a Capital One credit card, I have compiled the following rates and fees of the Platinum Secured card from the bank.

Capital One Credit Card Fees and Rates

The below fees and rates for a Capital One credit card reflect the most recent rates issued by the company.

- APR for Purchases, Transfers, and Cash Advances – 26.99%

- Annual Fee – None

- Transfer Fee – 3% of the amount transferred

- Cash Advance Fee – $10 or 3% of the amount advanced (whichever is higher)

- Late Payment Fee – up to $40

How I Manage My Capital One Credit Card

Account management of my Capital One credit card is easy with different channels to choose from. The bank has an online banking channel at www.capitalone.com or through its dedicated mobile app.

The Capital One mobile app can be downloaded on the Google Play Store for Android users and on the App Store for iOS users. Whether I opt for online or mobile banking, I can readily manage my credit card using any of these options even while I’m on the go.

Through these, I can keep tabs on my credit, as well as turn on the necessary alerts and notifications for transactions and purchases. I can also activate and lock my cards using only these channels. I also feel at ease knowing I can set up my Autopay for my credit card account so I don’t have to miss any payments.

Capital One Address and Contact Information

I can reach out to Capital One by its customer service hotline at 1-800-CAPITAL (1-800-227-4825). Meanwhile, its online banking support number is 1-866-750-0873. For those like me who have a secured card and would like to make a deposit, calling 1-800-219-7931 is key.

Those who would like to meet in-person with Capital One personnel may do so by setting up an appointment. The bank’s headquarters is located at Capital One Financial Corp., 1680 Capital One Drive, McLean, Virginia, 22102-3491, USA.

The Bottom Line

Getting a Capital One credit card is possible even for those who have less-than-stellar credit scores. With this guide, I believe that you, too, can rebuild your credit and even get maximum rewards with the help of Capital One and its comprehensive card offerings.

Disclaimer: There are risks involved when applying for and using credit products. Ensure you consult the bank’s terms and conditions page before agreeing to anything.

References

Platinum Secured – Capital One

Capital One website – Capital One

Capital One – Capital One Credit Cards, Bank, and Loans – Personal and Business

App Store –

Capital One Mobile on the App Store