Recently, I was on the hunt for a credit card that’s best for consolidating debt and getting relief from interest for an extended period of time. After a few months of looking, I was pleased to come across the Citi Diamond Preferred Card and what it has to offer its cardholders.

I was greatly impressed by this credit card from Citi because it’s an ideal card for people trying to make a significant reduction to their debt.

In this article, I will talk about the Citi Diamond Credit Card, its features, associated interest rates and fees, and how to apply for one. To know more about this credit card, continue reading the article below.

- An Overview of the Citi Diamond Preferred Card

- Benefits Provided by the Citi Diamond Credit Card

- Interest Rates and Charges to Keep in Mind

- Additional Information on Calculations and Payments

- Applying for a Citi Diamond Preferred Card

- The Citi Mobile App for Android

- The Citi Mobile App for iOS

An Overview of the Citi Diamond Preferred Card

The Citi Diamond Preferred Card is an attractive credit card for people like me who are trying to consolidate debt and reduce it at the lowest possible cost.

Its main selling point is its introductory 0% annual percentage rate (APR) for eligible balance transfers for a whopping 21 months. This period begins from the date of the first transfer.

Keep in mind that all transfers must be completed within the first four months of the account opening.

Another great thing about this Citi credit card is that it also offers 0% intro APR for purchases for a period of 12 months from account opening.

A Great Way to Reduce Debt

Sometimes people face emergencies at times when they do not have cash or insurance to cover these expenses.

The result is that they turn to their credit cards for easy funds, which could end up accumulating fast once interest begins accruing.

The Citi Preferred card’s introductory 0% APR period allows some breathing room to quickly and affordably reduce a large chunk of the debt during those 21 months.

Benefits Provided by the Citi Diamond Credit Card

Aside from the 0% introductory APRs, credit cardholders get to enjoy Citi Entertainment, a benefit that grants exclusive access to presale tickets for concerts, dining experiences, and sporting events.

Another great perk of the Citi Diamond Preferred Card is its focus on security. The bank offers its Citi Identity Theft Solutions and grants customers $0 Liability on unauthorized charges.

You don’t have to worry too much about identity theft because these cases are swiftly resolved. Citi also does not penalize its cardholders for unauthorized charges.

Convenience for Citi Cardholders

Convenience is part of the appeal of getting a credit card so I was impressed by how much effort Citi places on providing convenience to cardholders. You can speak with a customer service representative 24 hours a day, seven days a week.

To help with budgeting, Citi also allows clients to select their own payment due date. You also won’t have to constantly monitor your account because you may set up automatic account alerts for your payments due, credit limit, and balance levels.

The card’s assessibility through digital wallets allow you to confidently and securely shop online. The contactless, chip-enabled card also provides security and convenience through contactless pay.

Interest Rates and Charges to Keep in Mind

The 0% APR for both purchases and balance transfers for the Citi Diamond Preferred Card only applies during the introductory period. After that, it becomes between 13.74% to 23.74%, based on your creditworthiness.

The APR for cash advances is 25.24% while it’s between 13.74% to 23.74% for the Citi Flex Plan.

If you make a late payment or a payment is returned, a penalty APR of up to 29.99% will be applied indefinitely.

The minimum interest charge is $0.50. To avoid paying interest on purchases, make sure to pay your entire balance, along with your monthly Citi Flex Plan payment amount.

Other Fees to Consider

One of the things that I liked about the Citi Diamond Preferred Card is that it has no annual fee. However, there are several other fees that you should take note of.

In terms of transaction fees, the card has a balance transfer fee amounting to either $5 or 5% of the amount of each transfer, whichever is higher. Meanwhile, it’s either $10 or 5% for cash advance.

The foreign purchase transaction fee amounts to 3% of each purchase transaction while there are penalty fees of up to $40 for late payments and returned payments.

Additional Information on Calculations and Payments

Citi uses a method called “daily balance (including current transactions)” to calculate the cardholder’s balance.

Additionally, the company may opt to apply a portion of cardholders’ payments to the minimum payment due to reduce the APR balances first. Meanwhile, payments above the minimum will be applied to the highest rate balance first.

In case of a late payment, Citi may end the introductory 0% APR and even impose the penalty APR.

Using the Prime Rate in Calculations

Variable rates are calculated based on the 3.25% Prime Rate. However, these variable rates will not go beyond 29.99%.

To get the purchase, balance transfer, and Citi Flex Plan APRs, between 10.49% to 20.49% is added to the Prime Rate.

The cash advances APR is calculated by adding 21.99% to the Prime Rate while the penalty APR is equivalent to the prime rate plus up to 26.74%.

Applying for a Citi Diamond Preferred Card

Submitting an application for a Citi Diamond Preferred Card can be done online through the Citi website. The application form can be found online where I am prompted to enter my personal and financial information.

The personal data required include first and last name, Social Security Number, date of birth, mailing address, mobile number, and email address. I was also asked to indicate whether I’m a US citizen.

For the financial part, I was asked to provide my total annual income and my monthly mortgage or rent payment. I also had to indicate whether part of my total annual income was federal income tax exempt.

Bank Contact Information

If you have questions about the Citi Diamond Preferred Card or you want to check your application status, you may contact 1-800-823-4086 or 1-888-201-4523.

You may also send mail to the bank at Citibank Customer Service, P.O. Box 6500, Sioux Falls, SD 57117.

The bank’s corporate headquarters is located at 388 Greenwich Street, New York, New York 10013.

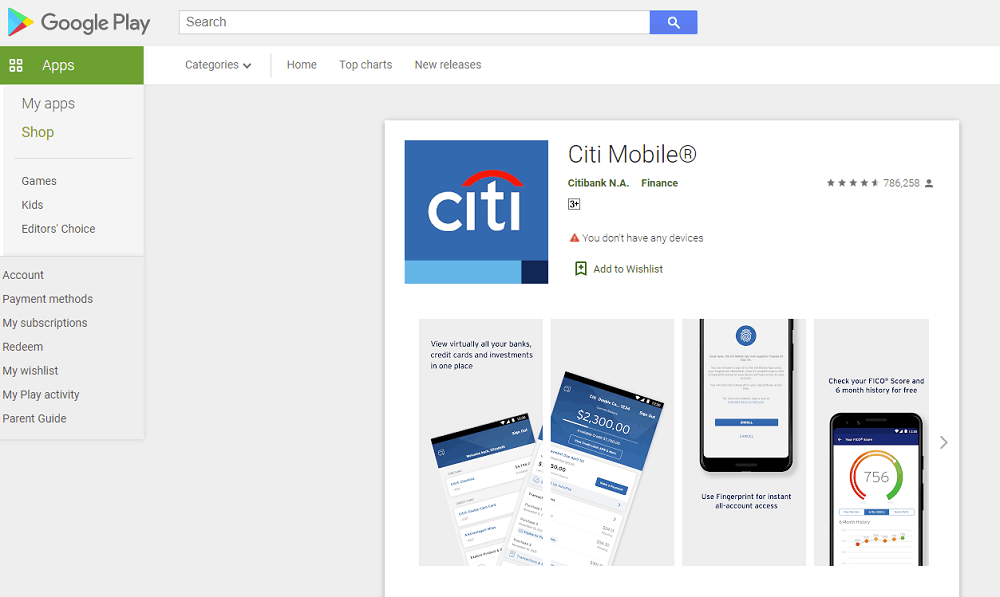

The Citi Mobile App for Android

I’m able to monitor and manage my Citi credit card using their mobile banking app. Fortunately, the app is available to both Android and iOS users free of charge.

Android users will find the app on the Google Play Store in the Finance category under the name “Citi Mobile”.

It has been downloaded more than 10 million times and this version of the app has a current rating of 4.6 out of 5 stars based on more than 780,000 user reviews.

Downloading and Installing the Android App

The Citi Mobile app has a file size of 91 MB and will require your device to run on Android 7.1 and up in order to function properly.

It is currently on version 9.46.1 and was last updated on November 19, 2021.

To start downloading the app, tap on the Install button and wait for it to complete the process. Once it’s finished, the app will automatically start installing on your Android device.

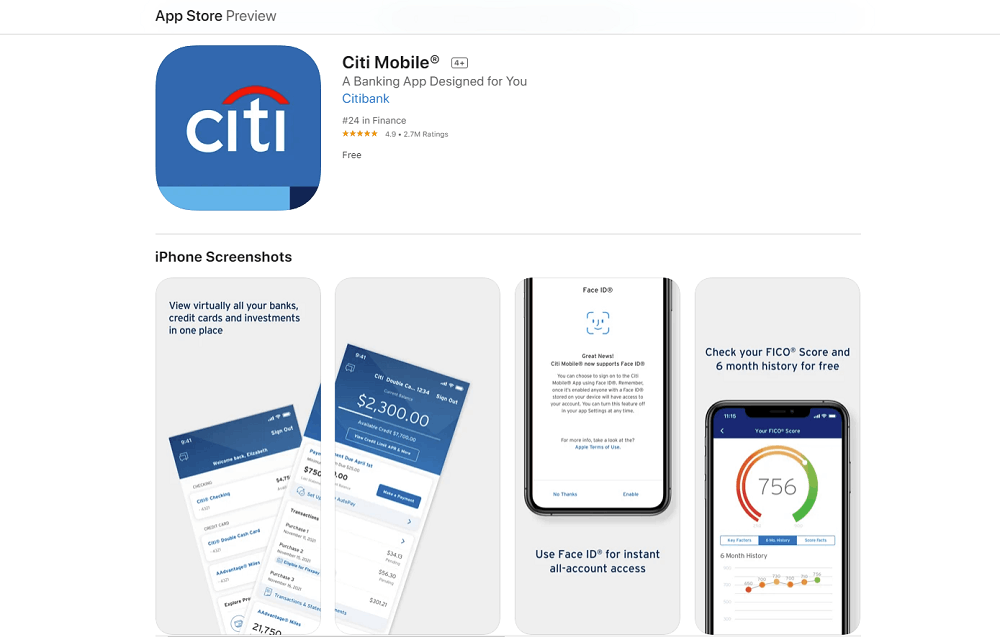

The Citi Mobile App for iOS

Meanwhile, iOS device users find the mobile app on the Apple App Store in the Finance category under the name “Citi Mobile: A Banking App Designed for You”.

The iOS version of the app has a current rating of 4.9 out of 5 stars based on 2.7 million user reviews.

Downloading and Installing the iOS App

The iOS version of the app has a bigger file size compared with its Android counterpart, needing 247.7 MB of storage space. It requires iOS 12.3 or later to work on both the iPhone and the iPod Touch.

To download the Citi Mobile app, tap on the Get button and wait for it to completely download all the necessary files.

Once all files have been downloaded, it will automatically begin installing on your iOS device.

Conclusion

The Citi Diamond Preferred Card is overall a great card, particularly for those trying to consolidate and reduce their credit card debt through balance transfers.

Note: There are risks involved when applying for a credit card. Consult the company’s terms and conditions page for more information.