From professional investors to the everyday person, more people are now holding some form of cryptocurrency. However, it’s not easy for crypto holders to access their cryptocurrency assets and use them beyond speculative trading.

It’s not very easy to use crypto to buy real-world items and services or put them into the bank. This is why several crypto cards have surfaced in the market recently.

In this article, I will talk about the Crypto.com Visa card, which claims to be the most widely accepted crypto card available. I will discuss its features, benefits, and how to apply for the card. If you want to know more, continue reading the article below.

- Examining Cypto.com and the Crypto.com Visa Card

- Features of the Crypto.com Visa Card

- Understanding the Crypto.com Visa Card Tiers

- Rewards Offered by the Crypto.com Visa Cards

- Crypto.com Visa Card Limits

- Applying for a Crypto.com Visa Card

- About the Crypto.com Mobile App

Examining Cypto.com and the Crypto.com Visa Card

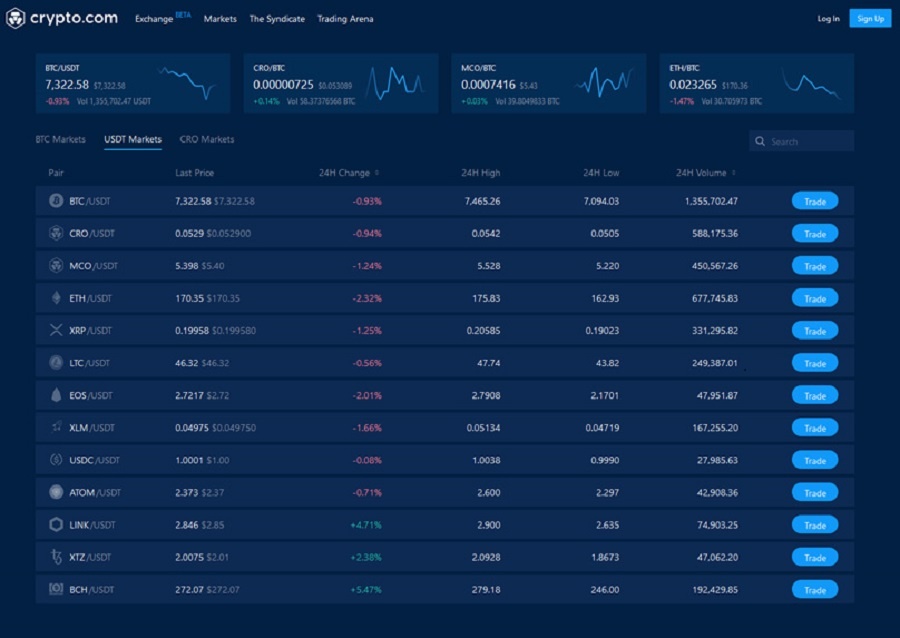

Most cryptocurrency investors and traders are familiar with Crypto.com, a platform or exchange that supports the trading and investing of crypto assets and other blockchain-related products.

The exchange is also able to convert your cryptocurrencies into your local currency. The company has released a prepaid card called the Crypto.com Visa Card.

The card allows you to directly spend your crypto anywhere around the world where Visa is accepted and get up to 8% cashback. It functions just like any other payment card.

Staking and CRO Rewards

What I found unique about this Visa card compared to traditional debit and credit cards is its staking requirement. In order for you to reap the rewards of the card, you will need to stake funds.

Basically, staking means locking a particular amount of money for a specific time period in a platform. In the case of Crypto.com, you will hold a specific amount of CRO token, the exchange’s intermediary currency, in your wallet for six months.

You are loaning out some of your CRO tokens in exchange for various benefits when using the Crypto.com Visa card. The amount you will need to stake depends on the card tier you’re applying for.

Features of the Crypto.com Visa Card

The Crypto.com Visa Card is neither a debit card nor a credit card but has aspects of both.

It’s the same as a debit card when it comes to its functions, but it earns rewards and rebates similar to credit cards.

It differs from a debit card in that debit cards are linked to a bank account, whereas prepaid cards need to be topped up in order to have funds that you can use for purchases.

In the case of the Crypto.com Visa card, it can be topped up using bank transfers, other debit and credit cards, or with your cryptocurrency.

Other Features of the Card

The Crypto.com cards are also contactless Visa cards, so you can tap to pay when you make purchases in-store.

The card also has no monthly maintenance fee. Crypto.com offers 24/7 customer support to cardholders, so you may reach out to them for queries and concerns.

Also, if you’re particular with the material of the card, you will love the Crypto.com Visa cards. They’re made from premium composite metal, except for the Midnight Blue option, which is made of plastic.

Understanding the Crypto.com Visa Card Tiers

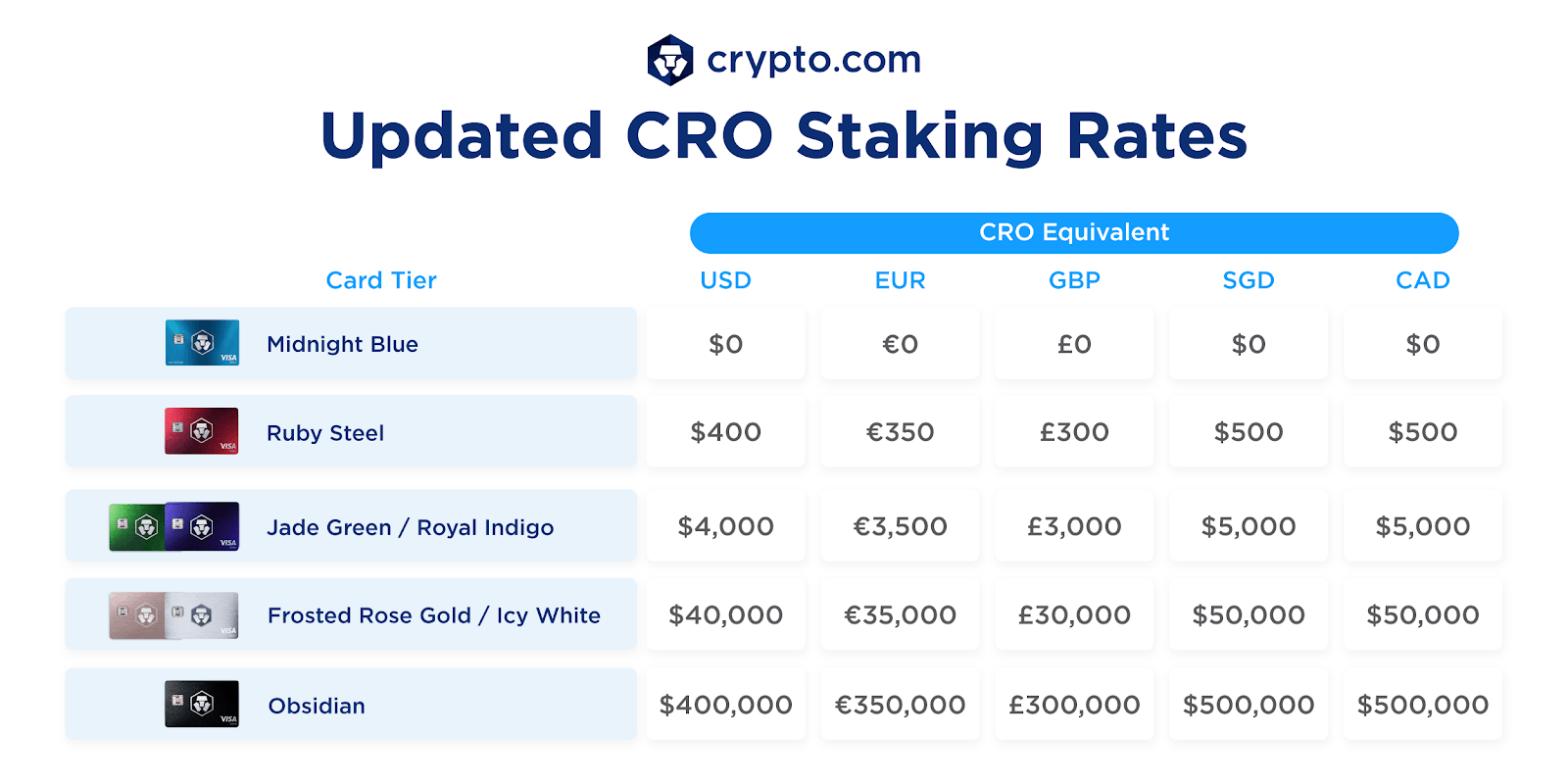

The Crypto.com Visa cards come in seven different colors and belong to five different tiers depending on the CRO staking requirement. I will specify the staking requirements based on current information on the official site.

The lowest tier card is the Midnight Blue, which requires no CRO stake at all, but it also gives the least rewards among all the Crypto.com Visa cards. This card is great for those who don’t want to stake but still want to earn cashback.

It is followed by the Ruby Steel card, which requires $400 in CRO stake, while the Royal Indigo and Jade Green cards have a $4,000 CRO stake requirement.

The Royal Indigo and Jade Green cards are the most popular because of their lower stake.

Higher Tier Cards

While the Ruby Steel, Royal Indigo, and Jade Green tiers are for people who are willing to stake a little in exchange for some rewards, the two remaining tiers are more expensive.

The Frosted Rose Gold and Icy White Crypto.com Visa cards belong to the same tier that has a $40,000 CRO stake requirement. Some experienced crypto holders might think that this is worth the investment.

Lastly, the most expensive tier is the Obsidian card, which requires a CRO stake of $400,000. An amount that you might say can only be held by the most lucrative of crypto investors.

Rewards Offered by the Crypto.com Visa Cards

The Crypto.com Visa Cards all provide cardholders cashback in the form of CRO tokens. The higher the tier of the card, the higher the percentage of cashback, starting from 1% for Midnight Blue up to 8% for Obsidian.

Unfortunately for Midnight Blue cardholders, that’s the only reward they can enjoy since they’re not staking anything.

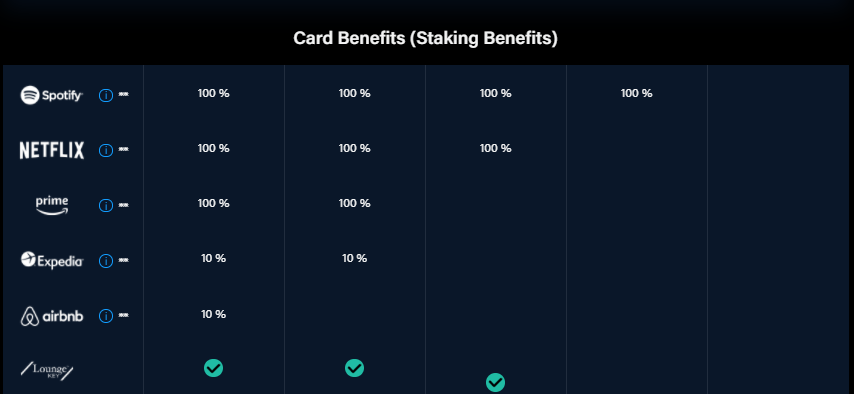

A further reward available for all other tiers is a 100% rebate on Spotify subscriptions.

Other rebate rewards include 100% for a Netflix subscription, 100% for an Amazon Prime subscription, 10% on Expedia, and 10% on Airbnb. You can check the table of rewards on the product page found on Crypto.com.

Other Non-Cash Back Benefits

Aside from the CRO cashback and subscription rebates, there are several other benefits enjoyed by Crypto.com Visa cardholders.

From the Royal Indigo tier up, they receive airport lounge access with additional guests for Icy white and Obsidian tiers.

The top two tiers also get Crypto.com Private membership, earn bonus rewards, and get an exclusive merchandise welcome pack. Only Obsidian cardholders get the perk of the company’s private jet partnership.

Crypto.com Visa Card Limits

I think that when looking at any kind of debit or credit card, it’s important to take note of its limits in order to avoid penalties. For the Crypto.com Visa card, the maximum card balance is $25,000.

The daily top-up limit is $10,000, and the weekly top-up limit is $25,000, but there is no yearly top-up limit for this card. In terms of withdrawal frequency, cardholders can do three daily and 30 monthly withdrawals.

The free ATM withdrawal limit per month will depend on the card tier. This limit is $200 for Midnight Blue, $400 for Ruby Steel, $800 for Royal Indigo and Jade Green, and $1,000 for Frosted Rose Gold and Icy White, and Obsidian.

Fees Associated with the Card

This is where the Crypto.com Visa Card truly shines. It has no issuance fee, no monthly fee, and not even a single cent of commission on spending.

It also has no minimum or maximum deposit. The only fee that you will encounter is the ATM withdrawal fee amounting to 2% of the transaction if you go beyond the specified limits mentioned earlier.

You may consider the CRO stake as sort of a fee because you need to maintain it to enjoy the rewards though it isn’t technically a fee and is rather an investment into Crypto.com.

Applying for a Crypto.com Visa Card

In order to avail of this Visa card, you need to have a Crypto.com App account. If you don’t have one yet, you need to sign up and undergo the know your customer (KYC) verification.

Next, you need to have the right amount of CRO tokens in your crypto wallet in the app, depending on the card tier you’re going for. You can buy CRO directly using the mobile app.

The final step is to visit the Card tab in the app and choose your desired Visa card.

Tap on the Stake CRO button and follow the instructions. Once done, you only need to wait for your card to arrive.

Contact Information

For any questions and concerns, you may reach out to Crypto.com through email.

Send your queries to [email protected] for general questions, [email protected] for regulatory concerns, and [email protected] for law enforcement queries.

Crypto.com’s headquarters is located at 111 North Bridge Road #08-19 Pennisula Plaza 179098, Singapore.

About the Crypto.com Mobile App

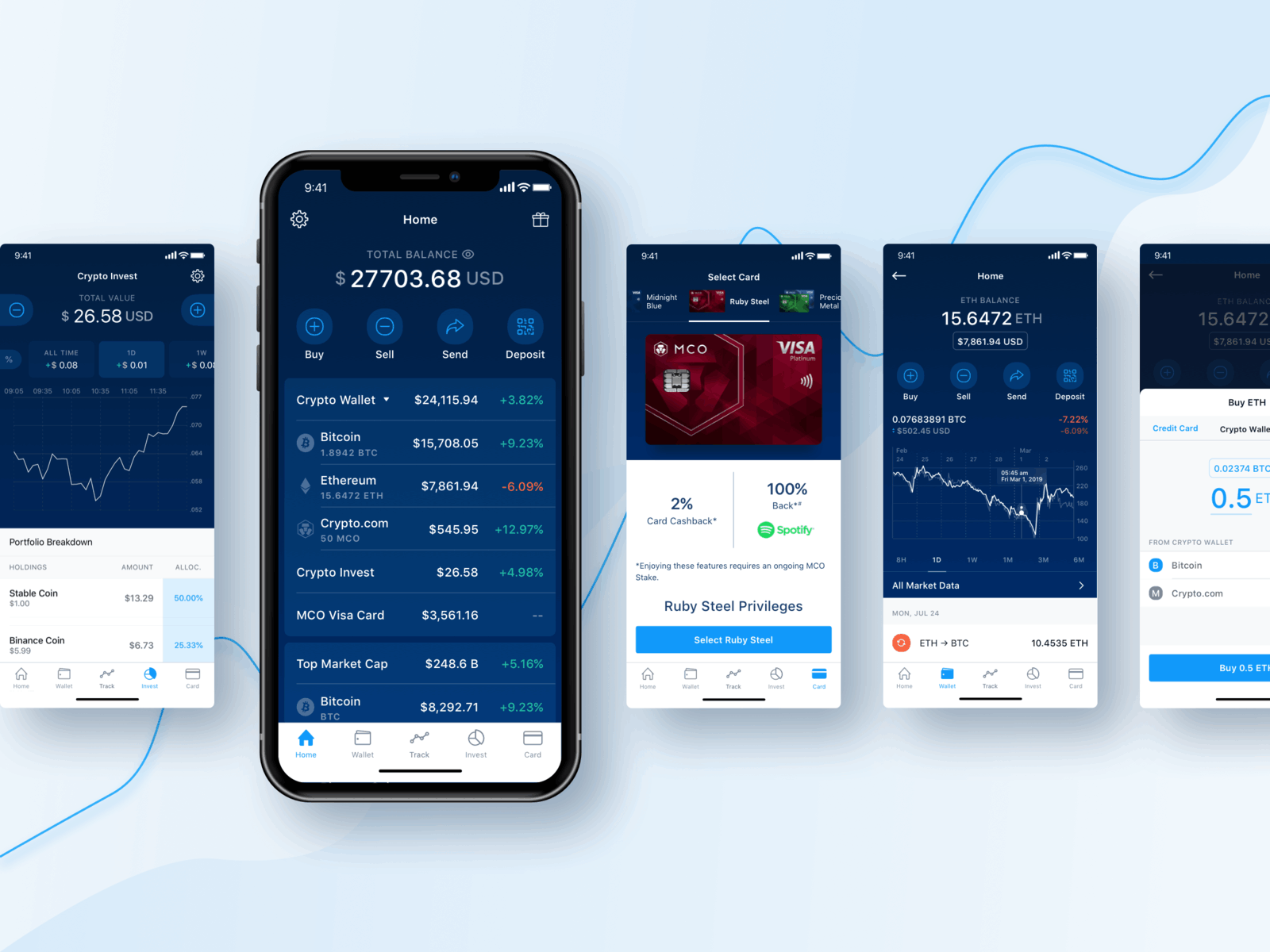

The Crypto.com mobile app is available to both Android and iOS platforms. The app is where you can do most of your transactions on the exchange, including management of the Visa card.

For Android users, you will find the app on the Google Play Store in the Finance category under the name “Crypto.com – Buy BTC, SHIB”. It currently has a rating of 4.1 out of 5 stars based on over 200,000 user reviews.

The app is currently on version 3.120.2, has a file size of 107 MB. It requires Android 8.0 and up to function properly.

Tap on the Install button to initiate the download and installation onto your device.

Crypto.com App for iOS

Meanwhile, iOS users will find the app on the Apple App Store in the Finance category under the name “Crypto.com – Buy BTC, ETH, SHIB”.

Currently, it has a rating of 4.3 out of 5 stars based on more than 57,000 user reviews. It is available in different languages, including English, French, Spanish, and Chinese.

This version has a file size of 379.7 MB and requires iOS 11.0 or later for both the iPhone and iPod touch. To download and install, simply tap on the Get button.

Conclusion

If you’ve been dabbling in cryptocurrencies like me and are looking for a way to directly use them to purchase products and services, you might want to consider getting a Crypto.com Visa Card.

Note: There are risks involved when applying for and using credit Consult the bank’s terms and conditions page for more information.