Living a life of luxury and one that matched my status was a dream that I always had. One of the status symbols that reflects this is no other than having a black credit card in hand. With one of these exclusive cards, I find that superior perks and advantages are just within reach.

One of the credit cards that cater to this particular lifestyle is no other than the African Bank Black Credit Card. This card claims to make an instant and even lasting impression, and rightly so with its impressive array of benefits.

Let me tell you what I liked about this credit card and how I applied for it through this article. Who knows, perhaps you too can get your hands on this card in no time. Check out more details about this card below.

- Get to Know African Bank with Me

- Benefits of the African Bank Black Credit Card

- Learning How to Apply for the Credit Card

- Fees and Rates of the African Bank Black Credit Card

- Managing My African Bank Credit Card

Get to Know African Bank with Me

African Bank is one of the leading South African banks in the country. It is a relatively new company, given that it was only founded in April 2016 by Sam Motsuenyane.

However, the original African Bank Limited, with which the current one is patterned, was established back in 1975.

It is considered a locally controlled bank by the South African Reserve Bank. The bank specializes in offering different financial products and services in South Africa.

These include personal loans, banking accounts, investment opportunities, credit card services, and insurance products.

Why Bank with African Bank

One of the reasons that I chose African Bank is that it offers a comprehensive range of products, including personal loans, insurance products, and even credit cards.

Besides this, I find that African Bank has some of the lowest banking fees on the market, making it ideal for people like me who want to save up.

Since I’m talking about credit cards, I believe it’s worth noting that African Bank has a black credit card, one of the most sought-after credit cards thanks to its exclusivity.

Benefits of the African Bank Black Credit Card

One of the main perks of having an African Bank Black Credit Card is that this particular credit card is something I can have right away from just about any African Bank branch. If I get a card it is embossed with my personal and card details immediately.

Moreover, I take pride in being able to set my own transaction limits up to R250K. While the financial institution can certainly set its discretionary limits, I can easily qualify for a credit limit increase when my account is six months or older. This new limit will also be readily approved by the bank.

What’s more, I find that African Bank’s offering of having up to 62 days of interest-free credit on POS and online purchases to be incredibly useful. With this offering, I can relax knowing that I have a long time before I even have to settle my balance in full by its due date.

As a savvy credit card owner, I appreciate being able to earn up to 3% on a positive balance. As a matter of fact, this is the first time I have ever seen this feature. This motivates me not only to pay on time but in full, knowing that I can earn more over time if I am responsible for my payments.

Other Advantages of Having an African Bank Credit Card

What makes an African Bank Credit Card different from the rest is that it comes with Credit Life Insurance. This lets me cover unexpected expenses, especially in case of emergency, disability, or death.

Powered by Visa, I feel at ease knowing that my credit card will be accepted just about everywhere Visa is accepted. I can tap this, swipe, or dip and simply enter my pin to complete my transactions. These are even equipped with SMS notifications to show me all of my transactions.

Despite shopping online and in different parts of the world, I’m not afraid of making purchases since I am protected with every step I take. I also have the pleasure of getting a one-time pin (OTP) to confirm and authorize transactions.

Learning How to Apply for the Credit Card

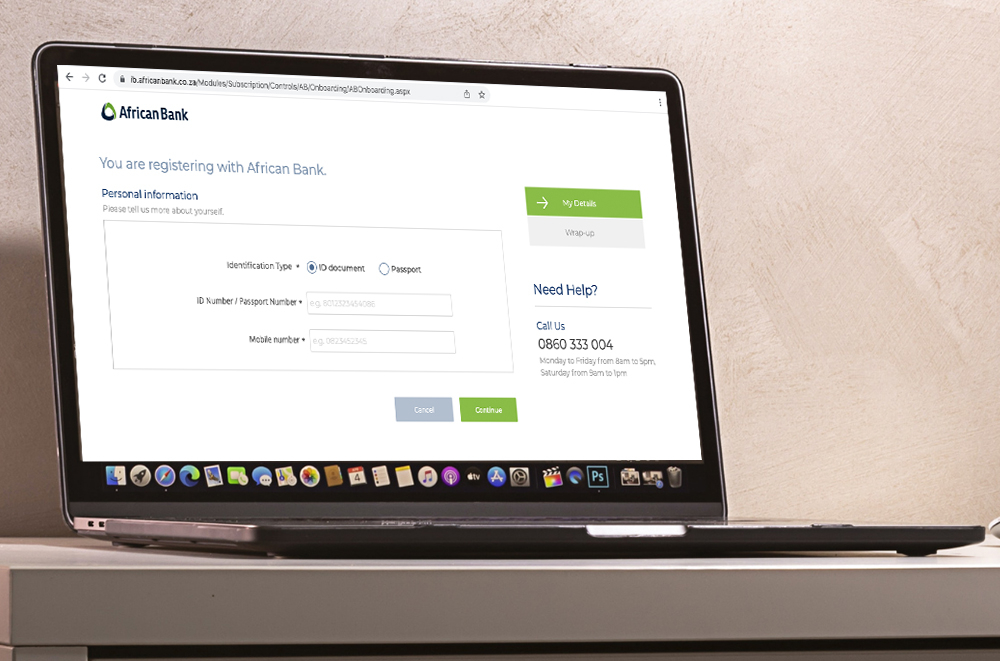

To apply for an African Bank Black Credit Card, I was presented with two options. I can either speak with one of the bank’s consultants by asking them to call me back or apply online. The first option requires me to provide my name, email address, South African ID, and cell phone number.

The second option, on the other hand, requires me to fill out an application form right on the website. The series of questions requires me to provide my personal details such as my name, cellphone number, and my email address.

The online application also asks me about my employment background. These include my employer’s name or company name, my salary, and how long I was already working there. The form likewise took note of my overall financial situation, especially as I was applying for a black credit card.

The application processing takes around 1 to 2 working days. The bank will then let me know if I have been approved for the African Bank Black Credit Card and my approved credit limit.

Eligibility Requirements and Qualifications

For this particular African Bank credit card, I only needed a handful of documents to prove that I not only needed this card for my lifestyle but also to show that I can support it. As such, I needed to provide the bank with my most recent proof of income.

In addition to this, I also gave the bank my latest bank statement. This should reflect at least three months’ worth of my salary deposits. While the financial institution did not specify a minimum income requirement, they will assess my capability based on the information and documents provided.

One main requirement of the bank is that I must at least be over the age of 18 to apply and qualify for a credit card at African Bank. Other documents that the bank may ask for include proof of income, proof of identification, and proof of residence.

Fees and Rates of the African Bank Black Credit Card

The African Bank Black Credit Card comes with corresponding fees and charges. However, these are not publicly displayed as charges may vary from one person to another. I believe this largely depends on the financial capacity of a person, particularly when using a credit card that fits into one’s lifestyle.

Despite having no credit card fees and charges on display, I think taking a look at the existing credit card rates for its other credit cards, such as the silver, gold, blue, and platinum offerings, will give us a closer idea of what we can expect. Here’s what I have found out.

The highest credit card at the time, the African Bank Platinum Credit Card, has a monthly service fee of R69. Meanwhile, it has a credit interest rate of 3% per annum, with an interest rebate of 3.5% per year. Other fees remain the same across the board, but be sure to clarify this with the bank.

- Fund Transfer Fee – R5.55

- Initiation Fee – R120

- Card Replacement Fee – R115

- Cash Back at POS – R7.75

- ATM Balance Inquiry – R5.75, R60 for international inquiries

- ATM Cash Withdrawals Above R100 – R11.50 (with an additional 1.50% of the transaction value)

- ATM Cash Withdrawals Less Than or Equal to R100 – R5.75

- Declined Transaction – R6.50

- International POS – R6.50

Managing My African Bank Credit Card

I can keep banking and even purchasing even while I’m on the go thanks to African Bank’s online and mobile banking services.

With this service, I can see not only my balances but also make easy repayments in part or in full. Thankfully, African Bank has its own mobile app available for Android and iOS users.

Apart from online and mobile banking, I can also make payments through branches, EFT, Visa or Mastercard, and many others.

Reaching Out to African Bank

For those who may have queries on the African Bank Black Credit Card or anything related to it, calling the bank’s customer service center at 0861-111-011 is the way to go. The bank is open to assist callers from Mondays to Fridays from 8 a.m. to 7 p.m. and Saturdays from 8 a.m. to 6 p.m.

Meanwhile, I believe those who wish to email the bank can reach the financial bank at [email protected]. Alternatively, individuals can also send in their mail at Private Bag, Midrand, 1685, Johannesburg.

Individuals who personally want to make an appointment with the bank can do so with African Bank’s registered office located at 59 16th Road, Midrand, Johannesburg.

The Bottom Line

Black cards are undoubtedly some of the most exclusive credit card lines out there. With its great benefits and its exclusivity, let’s just say there’s a reason I and many other individuals love the African Bank Black Credit Card, particularly its limit adjustment and ease of use.

Disclaimer: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.

References

African Bank Black Credit Card

iOS –

African Bank on the App Store