Having a credit card is one of the most convenient options for me when it comes to making cashless transactions. As a matter of fact, I love the ease it affords me when traveling, especially when I only want to bring the necessities with me.

The only problem with having a physical credit card is that despite it being thin and convenient, I still have the tendency to forget it at times. This leaves me feeling at a loss, particularly when I need it to pay for my transactions.

This is where Bip Credit comes in. With this virtual credit card, I can finally get the peace of mind I deserve knowing I can still spend more safely and more securely than ever just by using my phone. Get to know more about this card and how I applied for it in this article.

- What Is Bip Credit?

- Features and Benefits of Bip Credit

- Applying for Bip Credit

- Fees and Rates of Bip Credit

- Learning How I Manage My Bip Credit

What Is Bip Credit?

The Bip Credit is perhaps one of the newer kinds of credit cards on the market that completely does away with the need for a physical credit card. Instead, I discovered that it relies mainly on a corresponding app that I can use just like I would a traditional card.

Bip Credit stands out today for its cardless credit offering. This line of credit is quite fascinating to me given that I can still access my account and make the necessary transactions and purchases without having a physical card in tow.

The company claims to be the first financial institution in the United Kingdom to offer cardless credit in the country. Those who are accepted for this type of credit line can start using this for both contactless and online payments right away.

How it Works

I think that the beauty of having a cardless credit tool like Bip Credit lies in its similarities with a traditional and regular credit card. I can make purchases online and in-store, the only difference is that I can use Bip credit from my phone.

When I apply for this credit offering and get approved, I will be given a credit account that I can use to pay in stores with the help of Google Pay or Apple Pay. Otherwise, I can use the 16-digit Bip number as well as its corresponding expiry date and CVV for my online transactions.

The only catch I noticed with this credit offering is that I cannot withdraw cash at all. While this isn’t a big deal to me since the Bip Credit is all about digital transactions and purchases, I believe that I should make this known to others who are thinking of applying for this option.

Features and Benefits of Bip Credit

Bip Credit is a game-changer. I like that I can access everything I need on my phone, from making purchases to checking my balances. Powered by Mastercard, this credit card allows me to spend wherever Mastercard is accepted around the world.

One of the things that I personally like about Bip Credit is that it gives me control over what I need. I appreciate being able to stay on top of my spending every month by letting me turn on the spending or warning cap when I reach my limit. In fact, I can even freeze my account to prevent further spending.

Speaking of credit limits, Bip Credit gives a generous yet manageable credit limit starting from £250 to £1,000. This can be increased depending on the applicant’s creditworthiness.

To complement this, I appreciate being given just one interest rate that starts at 29.9% APR depending on my creditworthiness. The financial institution even foregoes any fees that relate to the card, making it ideal for beginners and newbies to cards.

Other Notable Features of the Card

Since everything is done online and through the dedicated Bip app, I think it makes a world of difference to have access to my balance right away instead of viewing this via an ATM. This way, I can keep tabs on my spending and transactions, while also seeing due dates that are nearing.

In addition to this, I am quite thankful for Bip Credit and how it helps me manage my finances. Through its in-app payment slider, I can readily see how much I can save in the future by paying more off my transactions every month instead of the minimum amount required.

I must also commend Bip for having excellent in-app messaging support 24 hours a day, seven days a week through its app. Whenever I have questions or clarifications, I can turn to this support and have them get back to me immediately.

Applying for Bip Credit

Many individuals worry about applying for a credit card, including me, and that’s usually because it comes with a background and credit check. Thankfully, Bip Credit understands this apprehension, so it helps that applying for this card doesn’t even impact my credit score.

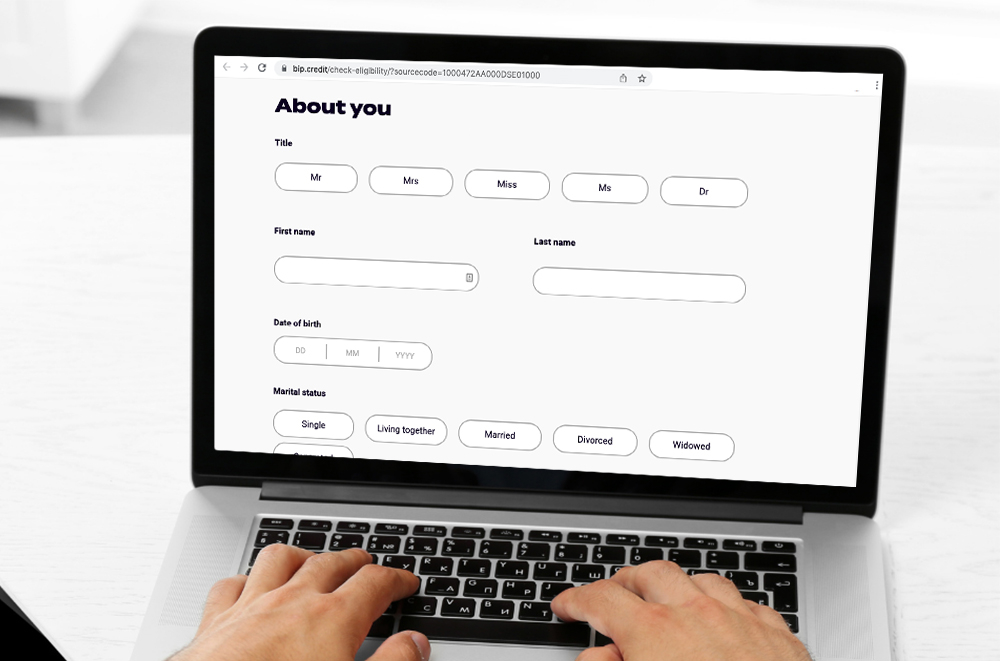

Instead, I can check with the online eligibility checker available on the website to see if I qualify for the card. Once I went over the qualifications, I filled out the form on the website.

The application form required me to provide my name, date of birth, marital status, email address, mobile number, residential status, and address, as well as my employment and income details. If I have been preapproved, I can download the app and apply for Bip Credit.

Once I have been approved for the card, I can simply add Bip to Google Pay or Apple Pay. The credit limit starts at £250 and the maximum credit limit is £1,000.

Qualifications and Eligibility Requirements

The Bip Credit is only available to individuals that live in the United Kingdom. This means I needed to have a permanent address in the country. To be able to qualify and be considered for this credit offering, I needed to be at least 18 years old.

Moreover, another eligibility requirement I was to fulfill was to have a current UK bank or building society account. I should also have a relatively good financial standing, meaning that I haven’t declared bankruptcy in the past 18 months or don’t have any bankruptcy proceedings at the moment.

Fees and Rates of Bip Credit

There are corresponding fees that come with the Bip Credit. By learning more about these prior to my application, I know what I am getting into and what charges I could come across in the future.

As mentioned, there are absolutely no fees with the Bip Credit offer. However, there is still some information that may be useful to those who are applying for this card. Take a look at these.

- Annual Fee – None

- APR – representative 29.9% variable APR or 49.9%

- Interest Rate for Purchases, Cash Transactions, Balance Transfers, and Money Transfers – 29.95% or 49.94% (depending on creditworthiness); BIP may make promotional offers from time to time

- Foreign Usage Fee – None

- Balance Transfer Charge – None

- Money Transfer Charge – None

- Late Payment Fee – None

- Overlimit Fee – None

What to Remember

This card does not come with any fees and charges, but that does not mean I don’t have to be responsible for making payments. If I happen to miss a payment, Bip will freeze my account and this instance will be reported to major credit bureaus, something which could greatly affect my score and rating.

To prevent this from happening, I tend to make payments on time and in full. This is a technique that prevents me from accruing more charges and interests while allowing me to stay on top of my finances.

Learning How I Manage My Bip Credit

I have been talking about the mobile app, but I have not fully explained where this can be accessed. The Bip mobile app can be downloaded and installed on the App Store for iOS users and on the Google Play Store for Android users.

Paying back my transactions is quite important to me, so I make sure to pay them back on time. This also helps establish a good credit rating. Thankfully, I can pay my balance by a direct debit facility which I can set up on the mobile app. Apart from this, I can also pay via internet banking or by using a card.

Getting in Touch with the People of Bip Credit

Bip Credit is offered by NewDay Ltd. Individuals who want to reach out to the company for any clarification may visit them at their registered office address located at 7 Handyside Street, London, N1C 4DA by making an appointment.

Alternatively, I can reach the Bip team through the Bip mobile app simply by going to ‘help’ and picking the ‘message the Bip team’ option. I can also call them at 0330 838 0115.

The Takeaway

I believe that Bip Credit is a great option for individuals who want access to a more convenient and hassle-free experience. With this credit card alternative being purely accessible by phone, I think that this can be a gateway option for those who are already tech-savvy and want to practice cashless living.

Disclaimer: There are risks involved when applying for and using a credit card. Please see the bank’s Terms and Conditions page for more information.

References

App Store –

Bip: Simple cardless credit on the App Store

Bip Credit – Bip | Cardless Credit You Control.

online eligibility checker – Check Eligibility

Terms and Conditions – Summary – Bip