Not all credit cards are created equal. Depending on what features you need, there are a lot of options out there. Some specialise in balance transfers, some focus on low interest rates, and others have been created especially for students.

In my personal quest for a credit card, I came across TSB Bank and its range of various credit cards. If you’re still undecided about which credit card to choose, you might want to consider the options from TSB Bank.

In this article, I will talk about the different credit card offerings from TSB Bank, their features, as well as the fees and interest rates associated with them. I will also discuss the application process for these cards and how to download the TSB Bank mobile banking app to manage them.

- A Look at TSB Bank’s Credit Card Offerings

- The Platinum Balance Transfer Card and Its Features

- Fees and Interest Rates for the Platinum Balance Transfer Card

- Features of the Platinum Purchase Card and Advance Credit Card

- Fees and Interest Rates for the Platinum Purchase Card and Advance Credit Card

- How to Apply for TSB Bank Credit Cards

- Downloading and Installing the TSB Mobile Banking App

A Look at TSB Bank’s Credit Card Offerings

TSB Bank plc is a retail and commercial bank based in the UK. It is a subsidiary of Sabadell Group. TSB Bank offers a variety of credit cards designed with a particular use in mind.

Its balance transfer cards are designed to allow you to move your credit and store card balances into one card without paying interest for a certain period.

Meanwhile, its purchase credit cards are perfect for buying goods and services regularly or for making a large purchase because of its fixed 0% interest period or low interest rate option.

Its low interest card was designed to be the ultimate shopping partner due to its promotional 0% interest rates and its lowest annual percentage rate (APR) of 9.9%.

Other Credit Cards in the TSB Bank Lineup

TSB also offers a student credit card for college or university students who have had a student account with TSB Bank for the prior three months.

It also has a classic credit card designed for people who have never had a credit card or those who want to start building their credit rating.

The Platinum Balance Transfer Card and Its Features

The TSB Bank’s Platinum Balance Transfer Card offers a 0% balance transfer period for a whopping 27 months.

This means that if balance transfers were made within the first 90 days of account opening, an interest rate of 0% will be imposed for up to 27 months. It also offers a promotional 2.95% balance transfer fee for the first 90 days.

Balance transfers must be a minimum of £100, up to a maximum of 95% of any UK credit card’s credit limit, except for TSB credit cards.

The minimum credit limit for this card is £500, and the maximum is subject to status.

Other Features of the Card

After the promotional period, users of the Platinum Balance Transfer Card may still enjoy an interest-free period of 56 days max for purchases if the balance is paid in full on time.

The minimum repayment is determined by adding the interest, default charges, and 1% of the balance indicated in your statement, with a minimum of £5, or the full balance if less than £5.

Eligibility for the promotional rates could be maintained by staying within your credit limit and making timely payments every month.

Fees and Interest Rates for the Platinum Balance Transfer Card

The Platinum Balance Transfer Card has a representative APR of 21.9%, but rates range between 21.9% to 27.9%, depending on individual situations.

Beyond the introductory rate, purchases are subject to monthly interest rates of 1.67%, 1.95% or 2.08%, or annual variable rates of 21.95%, 25.95%, or 27.95%.

Cash withdrawals are subject to interest rates of 2.08% monthly and 27.95% annually.

Balance transfers after the promo period have interest rates similar to those of purchases.

Other Associated Fees

While the card does not warrant any annual fees, it’s still subject to other fees. There’s a 3% or £3 minimum charge for cash withdrawals and a non-sterling transaction fee of 2.95% of the transaction value.

For balance transfers within the first 90 days, they are subject to a balance transfer charge of 2.95% of the amount. This increases to 5% beyond the first 90 days of opening your account.

The default for late payment charge and over the limit charge is £12.

Features of the Platinum Purchase Card and Advance Credit Card

The Platinum Purchase Card is a versatile credit card from TSB Bank that tries to give customers the best of both worlds when it comes to purchases and balance transfers.

It has the longest 0% interest rate promotional period for both purchases and balance transfers, reaching up to 15 months from the date of account opening.

A UK resident 18 years or older with proof of regular income is eligible to get this card as long as they are not currently declared bankrupt, subject to an individual voluntary agreement, or have County Court Judgments.

Advance Credit Card Features

TSB Bank’s Advance Credit Card prides itself as the bank’s lowest rate card with an APR of 9.9%. Its introductory 0% interest rate offer makes it a perfect shopping partner for customers.

For the first 90 days after opening an account, users of this card will enjoy 0% interest on purchases and balance transfers. What stands out for me as a big shopper is its compatibility with both Apple Pay and Google Pay.

Credit limits and interest rates are based on individual circumstances and are subject to status and lending criteria. UK residents aged 18 and above are eligible to get this card.

Fees and Interest Rates for the Platinum Purchase Card and Advance Credit Card

The Platinum Purchase Card is subject to the same interest rates and fees as those for the Platinum Balance Transfer Card except for the balance transfer fee. For the first 90 days, the balance transfer fee is lower, at only 1.45%.

Meanwhile, the Advance Credit Card has a representative APR of 9.9%, but actual APRs may range between 9.9% to 16.9%. Cash withdrawals have interest rates of 1.32% monthly and 16.95% annually.

Beyond the promotional period, purchases are subject to interest rates of 0.80%, 1.10%, or 1.32% monthly and 9.95%, 13.95%, or 16.95% annually.

There are no annual fees for both cards.

Other Fees and Charges Associated with Advance Credit Card

Cash withdrawals are subject to a 3% or £3 minimum charge, while the non-sterling transaction fee is 2.95% of the transaction value.

For the first 90 days, balance transfers have 0% charge but will revert to 5% after 90 days.

The default amount for the late payment charge and the over-limit charge is £12.

How to Apply for TSB Bank Credit Cards

Aside from the eligibility mentioned above requirements, such as legal age, UK residency, and regular income, you will need to prepare several things for your application.

You need to have your bank account number and sort code ready to share.

You will also need to provide information on address details for the last three years, as well as card details if you plan to transfer a balance.

The online application form will also require contact details, including home and work phone, mobile number, and email address.

Bank Contact Info

For help and support regarding TSB Bank credit cards, you may contact 0345 835 3846 between 8 A.M. to 8 P.M. If you’re calling from outside the UK, call +44 203 284 1581.

TSB Bank’s head office is located at Henry Duncan House, 120 George Street, Edinburgh EH2 4LH, Scotland.

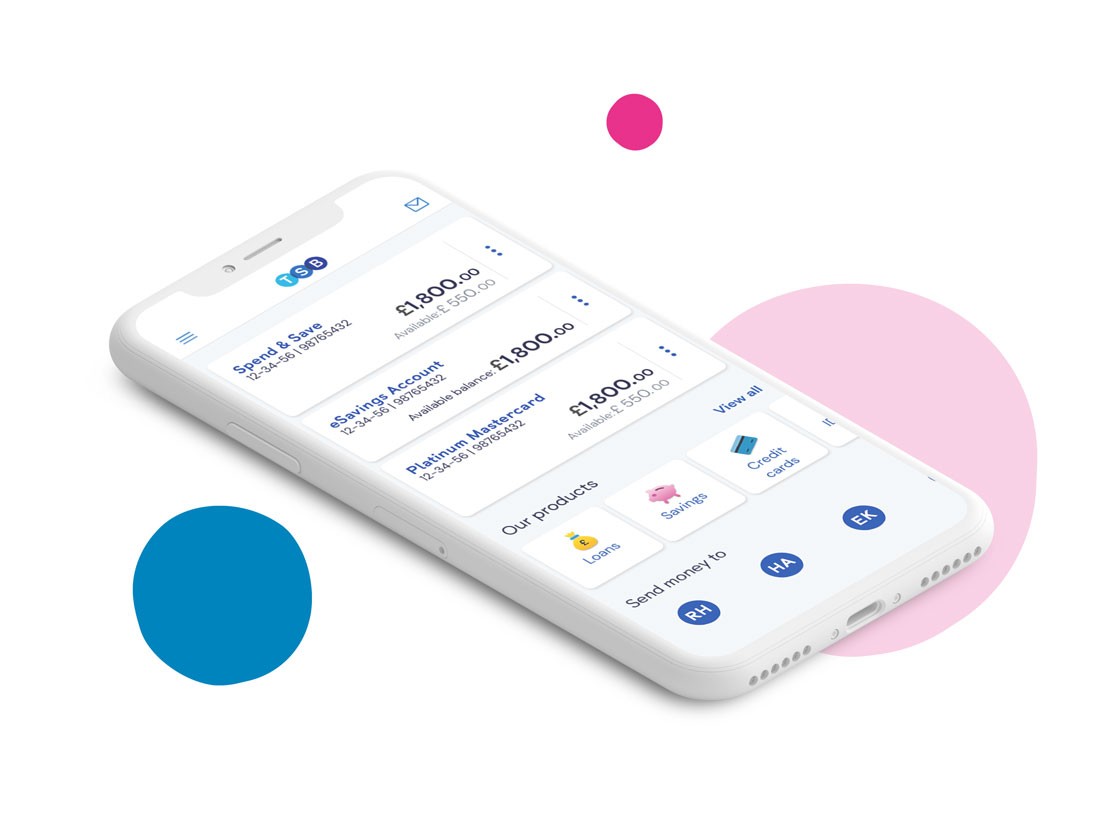

Downloading and Installing the TSB Mobile Banking App

To more conveniently manage your credit cards, you can use TSB Bank’s mobile banking app. First, make sure that you are already registered for internet banking and have already received your login details.

For Android users, you will find the app under the Finance category on the Google Play Store under the name “TSB Mobile Banking”. It currently has a rating of 4.5 out of 5 stars based on nearly 67,000 reviews.

The app will need 62 MB of free space and will require Android 5.0 and up in order to function properly.

Tap on the Install button to begin downloading. It will automatically install once the download is complete.

TSB Mobile Banking for iOS

The iOS version of the app is available on the Apple App Store under the name “TSB Mobile Banking”. It is rated 4.8 out of 5 stars based on over 300,000 reviews.

The app has a file size of 243.5 MB and requires iOS 11.0 or later for both the iPhone and the iPod touch. It is available in English and Spanish.

To download, tap on the Get button and wait for it to finish downloading and installing onto your device.

Conclusion

Overall, I found TSB Bank’s credit card options to be very attractive as they were all designed with specific purposes in mind. Whether you’re looking to get a card for purchases or balance transfers, there is a TSB credit card for you.

Note: There are risks involved when applying for and using credit cards. Consult the bank’s terms and conditions page for more information.