Credit cards have essentially one purpose, which is to allow you to make purchases and pay for them in the future. However, credit cards and their features have evolved over the years, and it’s sometimes hard to keep up.

Because I’m the kind of person who wants no-nonsense solutions to my purchasing needs, I’ve recently searched online for a credit card that is simple and straight up in nature. That’s when I encountered the NAB StraightUp Card.

In this article, I will talk about the NAB StraightUp credit card, its features and benefits, associated rates and fees, and how to apply for it. If you want to know more, continue reading the article below.

- A Credit Card with No Interest – Meet the Nab StraightUp Card

- Important Features of the NAB StraightUp Card

- How the Monthly Fees Are Computed

- Eligibility for the NAB StraightUp Card

- Overview of the Online Application Process

- The NAB Mobile Banking App for Android Devices

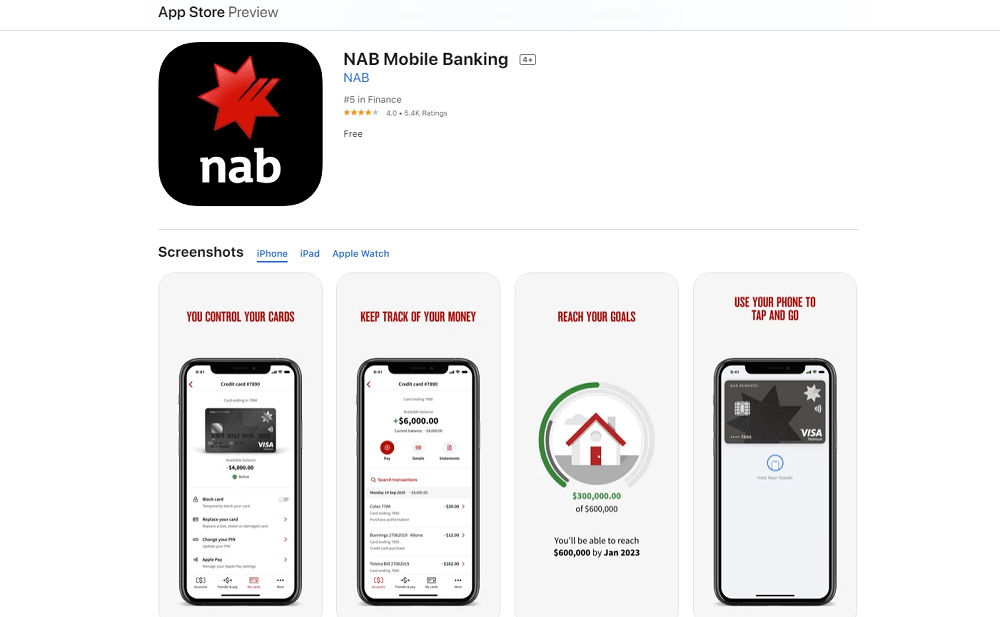

- The NAB Mobile Banking App for iOS Devices

A Credit Card with No Interest – Meet the NAB StraightUp Card

The NAB StraightUp credit card works differently from other credit cards you will find in the market. If you want a simple, no-nonsense credit card like me, this may be the one for you.

Traditional credit cards impose fees and interest based on the purchase amount or outstanding balance on your card.

The NAB StraightUp card, on the other hand, only charges a monthly fee depending on your credit limit and the amount you spend.

This makes it easier to predict how much you will need to pay monthly.

About NAB

NAB stands for National Australia Bank, one of the four largest financial firms in Australia based on market capitalization, customers, and earnings.

NAB offers a variety of products and services, including consumer banking, business banking, wholesale banking, insurance, and wealth management. Bank of New Zealand is its subsidiary.

As of January 2019, NAB has 3,500 branches, more than 7,000 ATMs, and over 9 million customers across Australia, New Zealand, and Asia.

Important Features of the NAB StraightUp Card

Along with having no monthly fees, the card also charges no interest. If you don’t use it during the month and you don’t have an outstanding balance, you won’t pay the fee.

This means that you won’t be surprised by fees, such as late payment fees, foreign currency fees, and duplicate statement fees.

I also like how the bank charges no annual fees for using the card.

Because of these features, the NAB StraightUp Card won the 2020 Mozo Experts Choice Award for Credit Card Innovation.

What You Won’t Get with this Card

Because it’s a simple and straightforward credit card, it lacks many of the features and benefits that you would find with other cards. If would like further benefits or features, you might want to consider other options from NAB.

If you spend a lot using credit cards and want extra perks like travel rewards, complimentary insurance, and miles points, you won’t get them by using the NAB StraightUp credit card.

In addition, take note that the card can only be used for purchases, so you won’t be able to use it for balance transfers or cash advances.

How the Monthly Fees Are Computed

I called this card simple and no-nonsense, and for good reason. You only need to remember your designated monthly fee based on the credit card limit given to you.

For cardholders with a credit limit of up to $1,000, your monthly fee will be $10.

A monthly fee of $15 will be charged to those with up to $2,000.

Finally, a $20 monthly fee is charged if you are given a credit limit of up to $3,000.

Know Your Minimum Payment

The minimum payments are also fixed depending on the credit limit. You will need to pay at least $35 towards any balance owing by the due date monthly for a credit limit of $1,000.

The minimum monthly payment for a credit limit of $2,000 is $75, while you need to pay at least $110 for any balance by the due date if you have a credit limit of $3,000.

What I liked about its fee system is that if I don’t use the card during the month and I don’t have any outstanding balance during the statement period, I won’t pay any monthly fee.

Eligibility for the NAB StraightUp Card

If you think that this credit card is the right one for you, you might want to take note of the eligibility requirements to qualify for the card. I found it appropriate that a simple card also has simple eligibility requirements.

You only need to be 18 years or older, receive a regular income, and be an Australian or New Zealand citizen.

Australian permanent residents or non-residents with an acceptable temporary residency visa may also apply.

Filling out an application form is also simple for existing NAB customers. You may use your NAB ID to pre-fill your personal and financial information.

Required Information for Applying for the Card

You can apply online even if you’re a new customer and don’t have a NAB ID. However, you will need at least one form of ID, either an Australian driver’s license, Medicare card, Australian passport, or international passport.

You will also be asked to provide your driver’s license number if you have one, your employment information for the past three years, and your income before and after taxes.

Applicants are also required to list down the assets that they own, such as cars and homes, outstanding debts, including personal, auto, and home loans. General living expenses will also need to be identified.

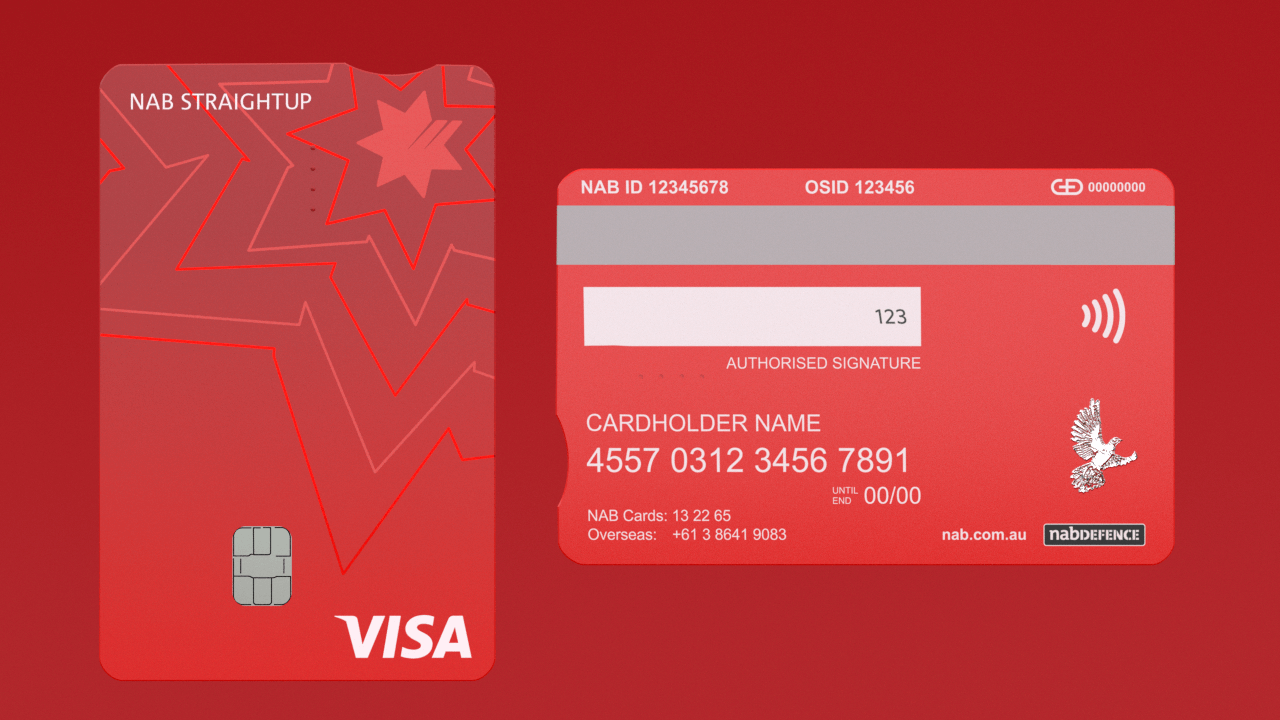

Overview of the Online Application Process

It took me about 15 minutes to complete the application form since I’m a new customer and don’t have an existing NAB ID. After submitting the form, I was able to receive a conditional approval after just a minute.

The bank then processed my application and asked for additional information and documents to verify my application, including bank statements and payslips.

I was able to receive my physical card within five working days following approval. I activated it using the NAB mobile app, but you can also use internet banking or visit a branch. I set up my digital wallet after that.

Contacting the National Australia Bank

For inquiries and concerns about the credit card, you may contact NAB by phone at 13 22 65 or +61 3 8641 9083 for those calling from outside Australia.

You may also chat online through the bank’s social media accounts, including Messenger, WhatsApp, and Twitter.

The bank’s headquarters is located at 800 Bourke Street Docklands, Victoria, Australia.

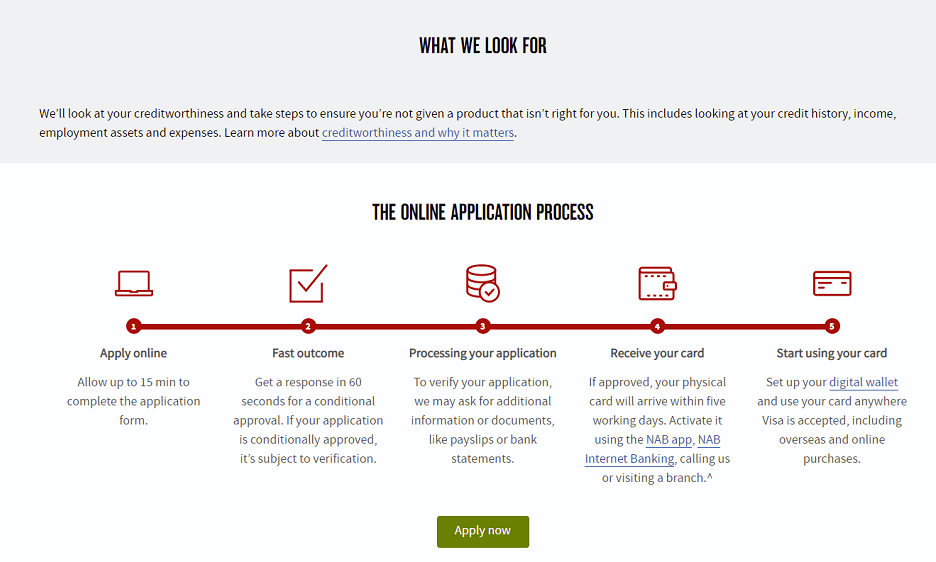

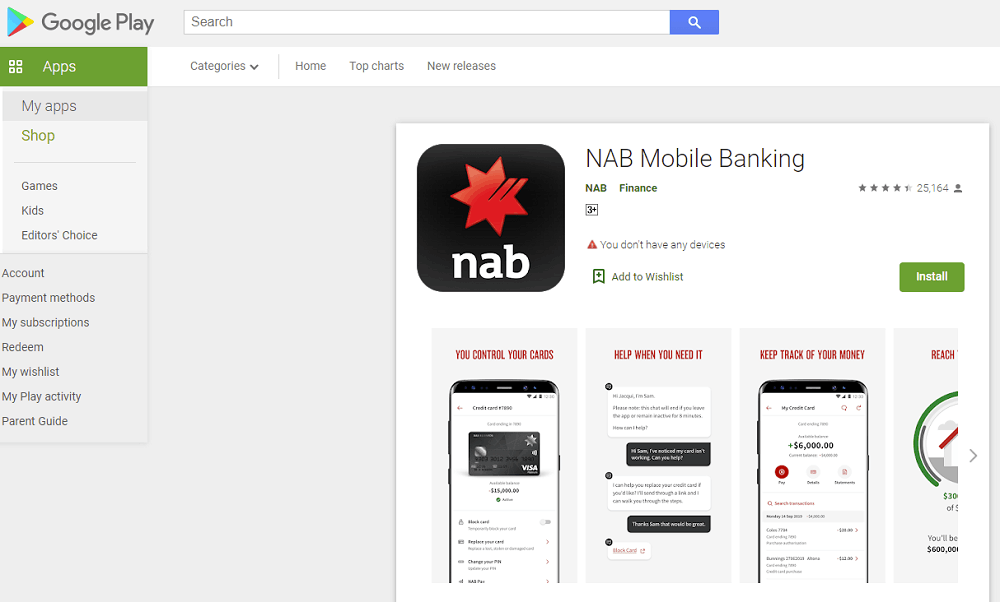

The NAB Mobile Banking App for Android Devices

I was able to monitor and manage my NAB StraightUp credit card using the NAB mobile banking app. It is available for both Android and iOS platforms and is free to download and use from the app stores.

For Android users, the app can be found on the Google Play Store in the Finance category under the name “NAB Mobile Banking”.

To begin downloading the app, tap on the Install button and wait for it to finish the download process.

Once this is done, the app will automatically install on your Android device.

Downloading and Installing the Android App

The NAB mobile banking app has a file size of 172 MB and will require your device to run on Android version 7.0 and up in order to function properly.

The NAB Mobile Banking App for iOS Devices

Users of Apple iOS devices will find the NAB mobile banking app on the Apple App Store in the Finance category also under the name “NAB Mobile Banking”.

To download the NAB mobile banking app, tap on the Get button and wait for the entire download process to complete.

Once all files have been downloaded, the app will automatically begin installation on your iOS device.

Downloading and Installing the iOS App

The iOS version of the app requires 232.2 MB of free space and iOS 12.0 or later to work on both the iPhone and the iPod touch.

It can also be used on an iPad running iPadOS 12.0 or later.

The Bottom Line

Overall, I really liked how simple and straightforward the NAB StraightUp credit card is. So, if you’re looking for a card where you don’t need to worry about interest or complicated fees, I recommend that you get this one.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.