Personal loans are one of the most popular types of loans and for good reason. Whether I need to cover emergency expenses for unexpected situations, consolidate existing debt, make home improvements or repairs, or even pay for a wedding, these loans come in handy.

Typically, I hear of many people turning to payday loans, especially in situations where they need to get money right away. While this is a fast way of dealing with debt, there are also risks to these payday loans, particularly with the high fees and the debt rollover that comes with it.

Because of this, I believe that turning to trusted and reliable lenders and banking institutions is the way to go. I have discovered that Virgin Money and their Virgin Money Loans are not only great payday loan alternatives but also offer superb benefits to any lender. Read on to learn more.

- Get to Know Virgin Money Loans

- Features and Benefits of a Virgin Money Loan

- Applying for a Virgin Money Loan

- Fees and Charges of a Virgin Money Loan

- Virgin Money Bank Address and Contact Number

Get to Know Virgin Money Loans

Virgin Money offers a comprehensive range of products designed to cater to a range of financial needs. From home improvement loans, car loans, and debt consolidation loans to the more flexible personal loans, Virgin Money strives to meet varying needs and concerns.

Home improvements loans are for fixing or selling a home, whilst car loans are made for purchasing the right vehicle. Debt consolidation loans can help in managing debt and bringing all debts together under one personal loan.

The Virgin Money personal loan, however, is something that I find to be the most flexible of all. As a matter of fact, one can even say that the three other loan categories fall under this category.

Virgin Money personal loans can be used for home payments and improvements, medical bills, car-related needs, and various other reasons.

How These Loans Work

These personal loans from Virgin Money are typically unsecured loans. This means I do not need to have collateral on hand or to give any of my assets up in order to get the loan in the event that I cannot repay it.

These loans are awarded in a lump sum, and I am expected to make manageable monthly payments until I repay the loan in full.

Provided I make my designated monthly payments on time and in full, my credit score and history remain in good shape.

Features and Benefits of a Virgin Money Loan

To fully get a grasp on what a Virgin Money loan has to offer, I will be zoning in on the personal loan offered by the institution. Apart from its flexibility of use, I appreciate that the Virgin Money personal loan lets me borrow anywhere from £1,000 to £35,000.

I can pay this over the course of one to five years, provided I am already an existing customer. Even better, I can stretch this payment period to seven years if I’m borrowing £7,500 or more.

To help me keep on track of my payments, Virgin Money only provides fixed rates. This way, I know exactly just what I am expected to pay every month, making it easier to manage my finances over time and eliminate any surprises that may arise.

On top of these, I am thrilled to know that Virgin Money loan applications are not only easy to acquire using the online app, but the process is fast and efficient. Money is sent to my account within two hours or by the end of the following day if my application is approved.

Flexibility at Its Finest

Getting a Virgin Money loan is just the start of my relationship with the financial institution. Besides the aforementioned benefits, there are also other perks that come with obtaining a personal loan. This includes getting flexible repayment terms and options.

With Virgin Money personal loans, I have the freedom to choose the monthly payment dates that are convenient for me. I can even change this up even when I have made my first payment.

Plus, I also get the peace of mind I need knowing I can easily borrow more and top up my loan should the need arise. I can do this by applying for a separate loan or simply combining my existing loan with the current one.

Applying for a Virgin Money Loan

Virgin Money loan applications must only be done through the mobile application. To do this, I must be registered for Virgin Money’s mobile banking, which means I must hold a Virgin Money current account.

I can also use Virgin Money’s mobile banking as a customer of its affiliate institutions: Clydesdale Bank, Yorkshire Bank, or B. Those who do not have any of these accounts or products need to open a Virgin Money account first.

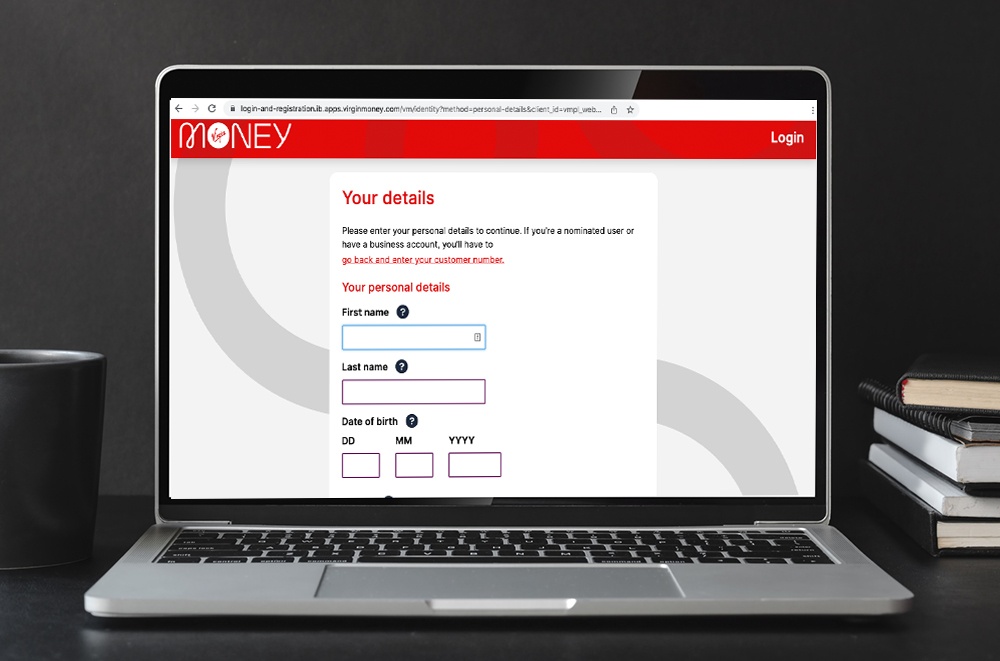

After opening an account and having my customer number in hand, I only need to download the app and input my customer number or my debit card along with my personal details. Applying for a Virgin Money loan required me to disclose the amount I intended to borrow.

Application Details and Fast Loan Approval

The application requires me to provide personal details such as my full name, addresses from the past three years, and contact numbers.

I also have to provide my employment information, including my employer, compensation, and start date, as well as information on my monthly expenses, such as any existing mortgage or rent.

If I apply between 8:00 A.M. and 10:00 P.M. from Mondays to Saturdays or from 8:00 A.M. and 9:00 P.M. on Sundays, Virgin Money will try to provide a decision right away. The longest they’ll take to give a decision is two working days. Once approved, I can get the money within two hours or at the end of the next day.

Eligibility Requirements that Come with Virgin Money Loans

The requirements to apply for a Virgin Money loan are being over the age of 18 and a resident of the United Kingdom. Additionally, I must not have applied for a loan with the company in the last three months.

Having a good credit history is also a must as it helps increase my chances of obtaining a loan. It’s important not to have a County Court Judgment (CCJ) or decree within the last three years.

I can check my eligibility before applying within the mobile banking app. This will have no impact on my credit score.

Fees and Charges of a Virgin Money Loan

There are no set fees and charges for a Virgin Money personal loan, and they vary depending on the amount borrowed from one individual to the next. This means that I can get a different set of fees and charges from what other people may have.

Virgin Money offers a representative example of what some of the fees could look like, which I’ve shared below.

- APR – Representative APR of 2.9%; ranges from 2.9% to 28.9% APR depending on creditworthiness based on a borrowing of £7,500 and to be paid over five years

- Fixed Interest Rate Per Annum – 2.9%

- Total Amount Payable – £8,059.01 (includes £559.01 interest)

- Monthly Repayments – £134.32

What to Remember

The rates and charges mentioned above are based on the representative interest rates available. As mentioned, these are all based on a borrowing amount of £7,500 and a repayment period of five years.

The minimum interest rate offered by Virgin Money is 2.9% APR while the maximum APR is 28.9%.

While paying back the monthly figure is ideal, I also have the option to pay everything right away or make extra payments to reduce the overall amount I need to cover.

Virgin Money Bank Address and Contact Number

Reaching out to Virgin Money is easy. I can contact them through their personal loan enquiries line at 0800 707 6471 or +44 141 951 7320 from Mondays to Fridays from 8:00 A.M. to 6:00 P.M. and Saturdays from 9:00 A.M. to 1:00 P.M.

Alternatively, I can make an appointment at their registered head office located at Jubilee House, Gosforth, Newcastle upon Tyne, NE3 4PL.

Managing Virgin Money Loans

The mobile banking app of Virgin Money is more than just a means of applying and getting a loan. This is also a way for me to manage my loan without much difficulty. I can also use the app to check my current balance and make repayments seamlessly.

Moreover, the Virgin Money app is also great for helping me manage my transactions and transfer money right away.

The Virgin Money app is available to download on the App Store for Apple users and on the Google Play Store for Android users.

The Bottom Line

Virgin Money loans are worthwhile options against payday loans, and other financing offers out there. With its flexible use and repayments, as well as its ease of application, I believe that borrowers like me can get more than favorable terms with what it brings to the table.

Disclaimer: There are risks involved when applying for and using a payday loan. Please see the bank’s terms and conditions page for more information.

References

Virgin Money loan applications – Service Temporarily Unavailable | Virgin Money UK

Virgin Money personal loan – Service Temporarily Unavailable | Virgin Money UK

terms and conditions – Service Temporarily Unavailable | Virgin Money UK

App Store –

Virgin Money Mobile Banking on the App Store