Recently, I’ve been looking at different credit cards that are accessible to people with little or poor credit history. While doing this, one type of card piqued my interest, and those are balance transfer cards.

Balance transfer cards are a great way to start building your credit score by transferring your higher-interest debt to a new card that offers significantly lower interest. This will make paying the debt back a little bit easier.

In this article, I will talk about one particular balance transfer card, the Post Office Classic Credit Card. I will discuss its features, associated interest rates and fees, and how to apply for one. To know more about this card, continue reading below.

- About Balance Transfer Credit Cards

- Looking at the Classic Credit Card from Post Office

- Examining the Interest Rates Imposed on the Card

- Applying for the Post Office Classic Credit Card

- Finding Out If You’re Eligible via the QuickCheck Tool

- Downloading and Installing the Post Office Mobile App

About Balance Transfer Credit Cards

The Post Office Classic Credit Card is an attractive option as a balance transfer credit card. To understand the card better, let’s discuss what a balance transfer credit card is first.

Balance transfer refers to the method of moving an outstanding debt from one credit card to another card. It is usually done by those who want to move an amount on one card to a new one with a significantly lower interest rate.

Balance transfer credit cards are those that either waive balance transfer fees or offer a promotional period where no interest is charged on the transferred amount. There are cards that offer both benefits.

Benefits of Using Balance Transfer Credit Cards

Balance transfers can lead to a significant amount of savings. Moving a balance from a credit card that imposes a high-interest rate to a new card with a promotional 0% interest for 12 months will help you pay it off more easily.

Most cards only require you to pay a balance transfer fee of around 3% to 5% of the amount you will be transferring. Some cards even waive this fee if you’re lucky enough to find an offer like this.

However, keep in mind that transferring a balance still requires making on-time monthly payments of at least the minimum due on the transferred amount. If successful, this could greatly increase your credit score.

Looking at the Classic Credit Card from Post Office

The Post Office Classic Credit Card is a straightforward Mastercard credit card offered by Post Office and issued by Capital One. It was previously issued by the Bank of Ireland UK.

Post Office only serves as a broker between Capital One and clients applying for the credit card.

The card is primarily aimed at people looking to rebuild their credit rating through a balance transfer or to spread out the cost of a purchase.

Post Office provides its own credit card eligibility checker called QuickCheck, to enable potential clients to find out whether they are qualified to get the Classic Credit Card. Using QuickCheck does not affect your credit score.

Features of the Post Office Classic Credit Card

As a balance transfer card, the Post Office Classic card offers a 0% interest rate on balance transfers for up to 12 months for eligible clients. However, it has a transfer fee of 2.9% of the amount transferred.

For those looking to spread out the cost of a purchase, eligible card users are entitled to 0% interest on purchases of up to 12 months. Keep in mind that these promotional rates are dependent on individual circumstances.

The credit limit will also depend on the client’s circumstances but has a minimum limit of £200 and a maximum limit of £8,000. The regular interest-free period for purchases is up to 56 days.

Examining the Interest Rates Imposed on the Card

When looking for a credit card, I always make sure to take note of all the rates and fees. The Classic Credit Card has a variable annual percentage rate (APR) that may fall between 19.9% to 34.9%, depending on the applicant’s circumstance.

The minimum monthly payment of this card is either 3% of the total outstanding balance or £5, whichever may be higher in value.

It may also be equal to the sum of the 3% of the outstanding balance, including any interest, default fees, and charges.

The card also imposes a 34.94% interest rate for money transfers and cash advances.

Credit Card Fees to Expect

A great thing I found about the Post Office Classic Credit Card is that it has no annual fee or monthly fees. It also does not have any duplicate statement fee, additional card fee, or dormancy fee.

However, it imposes a 2.9% balance of transfer fee and 2.9% money transfer fee. The foreign usage charge for both the European Union (EU) and the rest of the world is at 2.75%.

Other fees to expect are the cash advance fee of 3% with a minimum of £3, a late payment fee of £12, and an exceeding limit fee of £12.

Applying for the Post Office Classic Credit Card

Before applying for this card, I suggest that you first check if you qualify for its basic eligibility requirements. You need to be at least 18 years old, have a permanent UK home address, and have an annual income of over £8,000.

The online application process only takes between 10 to 15 minutes, but before you can proceed, you will be asked to use QuickCheck first to evaluate your eligibility and the rates you would probably get.

If your approval is successful, you may immediately begin to use your account online or through the mobile app.

The physical credit card will be sent seven to 10 working days following your approval.

Post Office Contact Information

If you have any questions or concerns, you may contact Post Office at 03444 810 902 or +44 344 4810902 if you’re calling outside of the UK. For existing applications, you may call 03444 810 905.

For lost or stolen cards, you may contact 0800 952 5095, or if it was lost or stolen abroad, contact +44 344 4810902.

You may also visit Post Office Ltd. at its headquarters located at Finsbury Dials, H B Markets Plc, 20 Finsbury St, London EC2Y 9AQ, United Kingdom.

Finding Out If You’re Eligible via the QuickCheck Tool

Since using QuickCheck is a prerequisite for applying for the Post Office Classic Credit Card, I also tried using this tool. I must say that this is a convenient way to find out whether I’d be approved without affecting my credit score.

The QuickCheck tool gives you a guaranteed result which means you don’t have to waste your time providing all the information for an application only to find out you don’t qualify.

Because it does not affect my credit score, I didn’t worry about other banks or lenders knowing about me considering the Classic Credit Card without formally applying for one yet.

How to Use QuickCheck

To use the QuickCheck tool, click on any of the “Check your eligibility” indicators you will find on the credit card page of Post Office’s website. When doing so, it took me to a form that I was able to fill out in about a minute or two.

QuickCheck will require you to provide personal information, such as your complete name, date of birth, contact details, residential status, and current address.

It will also seek information related to your work and finances, such as your employment status, occupation, and annual income before taxes.

Downloading and Installing the Post Office Mobile App

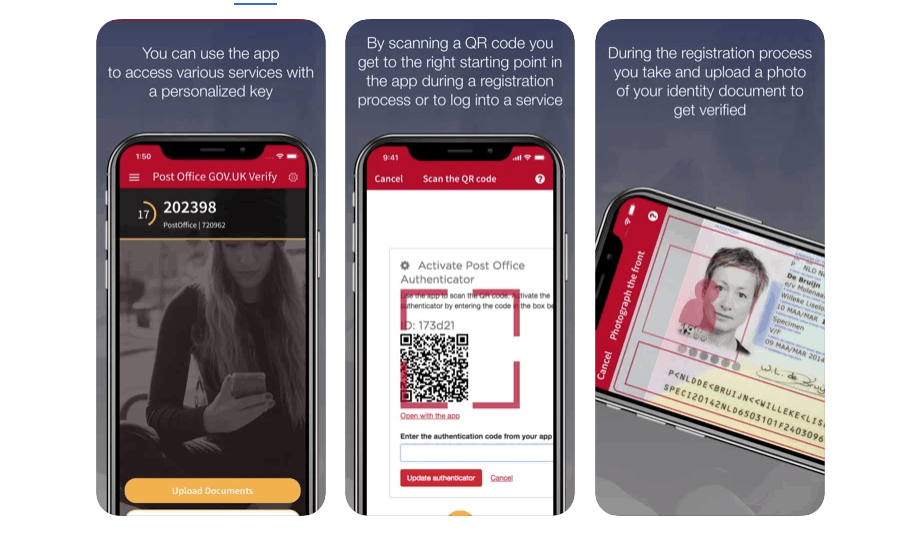

Aside from accessing and managing your credit account through the website, I also learned that you could do this using the Post Office mobile app. The good thing is that it’s available to both Android and iOS.

For Android users, you will find the app on the Google Play Store in the Productivity category under the name “Post Office GOV.UK Verify”. It has a rating of 4.0 out of 5 stars based on over 13,000 user reviews.

The app, currently on version 5.26.0 (850), has a file size of 17 MB and requires Android version 7.0 and up to function properly.

Tap on the Install button to download and install the app on your device.

Post Office App for iOS

On the other hand, iOS users will find the app on the Apple App Store. Users can search for the app by the name “Post Office GOV.UK Verify”.

This version has a file size of 102.4 MB and requires iOS 12.0 or later for both the iPhone and iPod touch and iPadOS 12. 0 or later for the iPad.

To download and install the app on your Apple device, simply tap the Get button.

Conclusion

I found the Post Office Classic Credit Card to be a great balance transfer card, as well as a credit builder card for those looking to improve their credit score. It’s a great card to use in the short term, but its lack of other perks may not make it very attractive as a long-term credit card.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.