There are times in life when I need access to money fast. From dealing with emergencies to buying big-ticket items and appliances for my home, having the capacity to get loans that dispense money quickly gives me the peace of mind I need.

This is where the Lamina Online Loan comes in. Known for its fast and efficient disbursement of funds and easy application, I find that turning to a reliable lending institution can provide me with everything I need and more. This is especially true when dealing with stressful situations.

For individuals like me who are interested in applying for an online loan from Lamina, look no further. I will walk you through the whole process and give you an overview of what the company has to offer.

- Learn More About the Lamina Online Loan

- Get Funds Fast and Easily

- Walking You Through the Application Process

- Rates and Fees of a Lamina Online Loan

- Reaching Out to Lamina Online Loan

Learn More About Lamina Online Loan

Lamina offers short-term loans to Canadian consumers. Applicants can apply and get approved conveniently online. Individuals also have the option to speak with a qualified agent from the institution.

I discovered that Lamina specializes in providing qualified consumers with loan amounts of up to $1,500 in as little as 12 hours. As a matter of fact, returning customers who are eager to get a loan again may be approved and receive their funds within one hour.

In many ways, I believe Lamina loans to be a type of short-term loan that is almost akin to a payday loan. This means they are perfect for when I’m in a pinch or simply need cash right away.

Different Loan Amounts for Every Need

Not everyone needs a loan of $1,500 every single time, which is why I found it convenient and assuring that I can borrow different loan amounts according to what I need to address at the time. The smallest amount that I can borrow is $300, while the biggest amount is $1,500.

While the amount I can borrow starts from $300, I find that borrowers can choose what range or the amount they’re comfortable to start with as the available loan amounts increase by increments of either $50 or $100 as you go higher, making them one of the more affordable small loans on the market.

Given this, I appreciate that Lamina loans offer me and other borrowers out there access to small amounts of money right away without having to deal with the usual demands of a payday loan.

Get Funds Fast and Easily

It seems to me that urgency is a huge part of Lamina’s core values which is why they give out funds in just 12 hours or less. In fact, I discovered that previous or repeat borrowers can even get their funds in an hour or less.

Even better, funds immediately make it to my account before 10 a.m. the following morning. This can even be faster should I make a deposit request through e-transfer within an hour of having my application approved.

In addition to the fast disbursement of funds, I find the application process to be relatively easy as well. The application process only takes around 10 minutes to fill out online. This process can also be completed with the help of an agent via a phone call.

Manageable Repayments Over Time

Funding is relatively convenient and efficient, but many are deterred from borrowing from lending institutions due to the repayments. Thankfully, Lamina makes this easy as well.

I found that rather than having just a few days or weeks to pay these short-term loans, Lamina makes it better by giving borrowers like me several months to do so. This makes payments smaller and more manageable than ever, especially as it gives me the chance to prep my payments.

Knowing I can make payments for three to five months, or anywhere from 90 days to 210 days, gives me enough leeway I need to pay the amount I have borrowed on time and in full. Most customers of Lamina even make weekly payments anywhere from $63 to $90 depending on the arrangement.

Walking You Through the Application Process

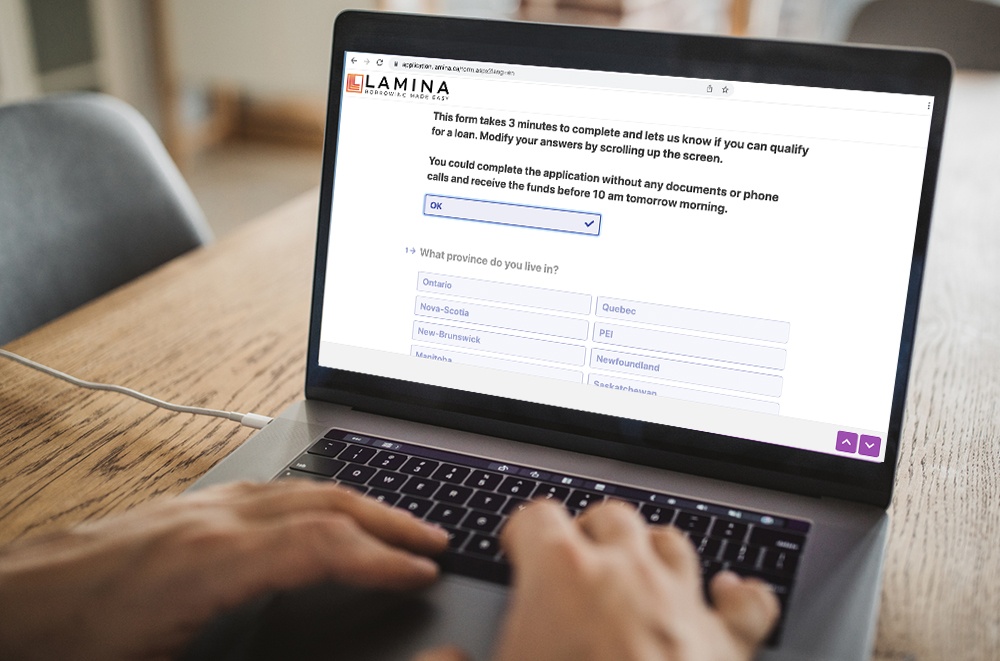

Applying for a Lamina Online Loan is perhaps one of the easiest processes I have ever come across. There is no credit check involved and only minimal documents are required. However, I found that to take advantage of this online application, I needed to provide my banking information.

The application process is pretty straightforward. Before I started, the application form has a three-minute pre-qualification form that will allow me to gauge whether or not I can get a loan. I provided the province I lived in, my source of income, the amount I get every payday, and how these payments are deposited.

The application form also asked me about any loans I may have taken out. After I provided the necessary information, Lamina informed me that they could pre-approve me for a loan and I could take out anywhere from $300 to $1,500. At this time, I could also view the overall cost and repayments.

To complete and proceed with the application, all I needed to do was provide my bank statement.

Eligibility Requirements

The base criteria to get a loan from Lamina is also relatively simple. First, applicants must have a steady stream of income and be at least 18 years or older. Lamina cautioned that there may be government incomes counted, but not all will be welcomed, so be sure to take note of this.

Those with online bank accounts like me will not need to submit any more documents. However, I discovered that those who do not have online banking may need to provide their pay stub, 30 days of bank statements, a void cheque as well as a piece of photo ID via email or mail by fax.

Rates and Fees of a Lamina Online Loan

The rates and fees that come with a Lamina Online Loan vary from one person to another. After all, this is largely dependent on the amount borrowed and the payment scheme that a borrower will be undertaking.

For example, if I were to take out a loan of $900 and was paid weekly, I would need to make a total of 19 repayments of $73.52 each. This would amount to $1,396.80 over a period of five months. This already includes all the fees plus the interest rate.

For a Lamina loan, you can expect an average annual interest rate of 30%. However, this rate does not include brokerage fees. The APR including brokerage fees comes out to around 120% to 250% in total. Plus, it is important to keep in mind that every missed payment will result in a $45 fee.

Flexible Repayment Scheme

The repayment term of Lamina loans is anywhere from 12 weeks to 18 weeks or approximately 90 days with a maximum repayment period of 210 days.

With the generous amount of time given, I find it astounding to know that Lamina still offers a possible extension to the deadline based on the terms of the contract. Alternatively, I appreciate being able to pay the full amount any time and have a discount on the fees.

Reaching Out to Lamina Online Loan

I know that there are a number of ways to contact and reach out to Lamina. The most convenient way is perhaps to send them an email at [email protected]. I could also text them at 514-700-6051 or call them at 1-800-639-2733.

I could also make an appointment to visit Lamina and talk with a financial advisor or agent who could guide me through my loan application.

Their address is located at 701 West Georgia Street, Office 1500, Vancouver, BC V7Y 1G5 with office hours from Mondays through Fridays from 8 am to 5 pm.

Learning How to Manage the Lamina Online Loan

Given that I have opted to get a Lamina Online Loan, managing and reimbursing the loan is at my fingertips. The lender will instantly draw funds directly from my bank account when my income deposits come in. Meanwhile, the brokerage fees that Lamina has will be drawn up last by the lender, and after the capital and interest are completely paid off.

I want to emphasize that although getting a Lamina Online Loan is quite simple, payday loans or short-term loans may not be for everyone. They tend to have higher interest rates and fees compared to other traditional types of loans on the market today.

As such, I believe refraining from taking out too many loans with this nature and paying back payday loans on time will help me and other borrowers from being burdened with debt.

The Bottom Line

I believe that a Lamina Online Loan is a great option for applicants like me who want quick access to funds without too much fuss. Their generous and flexible repayment schemes allow me to manage my loan and finances better.

Disclaimer: There are risks involved when applying for and using a loan. Please see the bank’s Terms and Conditions page for more information.

References

online application – Lamina | Loan up to $1500 with no credit checks, documents or faxes