Looking at a financial market, there is a wide variety of fintech companies that offer personal loans. Among the most popular is Marcus by Goldman Sachs. Yes, you’ve guessed it right – its parent company is Goldman Sachs Group Incorporated.

Advertised for its friendly fees and APR discounts, I was interested in finding out if Marcus personal loans are a good choice. To do that, I applied, tested it, and discovered an array of perks as well as a few downsides. Let’s get started!

- The Basics of Marcus Loan

- How to Qualify for Marcus Personal Loan

- Applying for Marcus Personal Loans

- Who Is the Marcus Loan Best for?

- Marcus Loan Terms and Amounts

- Marcus Loan APR and Fees

- Main Advantages of Marcus Loan

- Drawbacks of Marcus Loans

- How Does Marcus Compare to Other Personal Loans?

- Marcus Contact Details

The Basics of Marcus Loan

Before I get into the application process and verdict of whether it is a worthy choice, it is essential to explain the concept behind it.

Similar to SoFi and Upgrade, it doesn’t have a physical location and is a fintech company that offers a wide variety of repayment options.

Highlighted by zero start-up and origination fees, I saw Marcus as one of the best options for people who want to borrow anywhere between $3,500 and $40,000.

Among the many fee-related benefits is the fact that I was allowed to change the payment schedule up to three times in the course of the loan.

Multiple Uses

While Marcus does support a wide variety of purposes, it is most commonly used to settle credit card debt and finance home improvement expenses.

Keep in mind that similar to Upgrade, this personal loan can’t be used for covering daily living costs or going shopping for clothes.

How to Qualify for Marcus Personal Loan

The application process is pretty simple and can be done through a telephone line or the Marcus official website.

The first step was to make sure that I met all the eligibility criteria. Requirement number one is to be 18 years or older, which translates to the legal age of 19 in Alabama, and 21 in Puerto Rico.

While Marcus by Goldman Sachs doesn’t disclose the minimum credit score, I found that it is set at around 660.

Not only did I conclude this through my experience, but also by reading reviews of people with poor credit scores who didn’t get approved.

Proof of Income

Keep in mind that the higher the FICO score, the lower the APR will be.

Similar to applying for any credit card or a personal loan, I was asked to provide my social security number and proof of income.

Once again, Marcus doesn’t disclose a minimum income, but the idea is it should be high enough that you can cover monthly payments on time.

Applying for Marcus Personal Loans

Once I was sure about my eligibility, it was time to apply for the loan.

The first step is filling in basic information either through an online inquiry or by talking to an operator on a telephone line.

After that, the fintech company did perform a soft credit check that didn’t influence my FICO score whatsoever.

After I got the quote and the credit rate, it was time to either accept or decline the offer.

Getting Approved

Given the fact that I was pretty happy with the proposed APR, I accepted allowing the lender to perform a series of hard credit checks.

I also had to provide other information such as Photo ID, SSN, and TIN.

The final step of the application procedure is to sign the loan agreement and wait for the funds. I was pretty lucky to have the funds arrive in as little as two business days.

Who Is the Marcus Loan Best for?

First and foremost, with the approx minimum FICO score for getting approved being set at 660, it is safe to say that Marcus isn’t the best for people who have a bad credit history.

Still, it leaves a lot of room for borrowers with a good or an excellent credit given the flexible loan terms and the fact that the minimum loan sum is $3,500 while the maximum is just around $40,000.

In addition to that, it doesn’t allow for a joint application which translates to the fact that no one can apply for a loan with a co-signer or a co-borrower.

On the other hand, the wide variety of loan uses, including financing a home improvement, wedding, vacation, relocation, and debt consolidation, makes this loan a pretty attractive option.

What it Can’t Be Used for

Similar to a lot of personal loans, Marcus informed my that I couldn’t use the money for gambling activity, purchasing a house, or refinancing student tuition.

Additionally, any involvement with illegal activity is strictly prohibited, along with the inability to use this personal loan for investing in stocks or cryptocurrencies.

Marcus Loan Terms and Amounts

One of the biggest advantages of Marcus loans is that it offers a flexible repayment schedule as I was able to choose a period between 36 and 72 months.

Not only that, but it is one of the rare fintech companies that allow its borrowers to change the terms up to 3 times throughout those few years.

The terms also depend on the loan amount and creditworthiness. The better the FICO score, the longer the repayment period.

Talking about the maximum sum that I could apply for, Marcus sets the limit between $3,500 and $40,000.

How Does the Loan Amount Work?

The most important thing to consider is that anyone who doesn’t have a great credit score can’t get the maximum loan.

In addition to that, Marcus decides on whether they will approve the sum by considering the applicant’s creditworthiness, income, and purpose of the loan.

Marcus Loan APR and Fees

One of the coolest points of the Marcus Personal Loan is that I wasn’t met with an extreme annual percentage rate.

The minimal APR is set at 6%, while the maximum is just 19.99% which is pretty great when you compare it to similar fintech companies such as Upgrade (up to 35.97%).

Additionally, I was happy that Marcus offered a discount on auto-pay and direct payments to the lender.

Judging by my experience, it is anywhere between 0.25% and 0.5%, which is once again pretty friendly.

What About Late or Early Payments?

Most importantly, there aren’t any origination or startup fees common for other personal loans.

As Marcus by Goldman Sachs is focused on providing the best terms and conditions for paying off the loan, I wasn’t surprised that they don’t charge late payments or pre-payment penalties.

Main Advantages of Marcus Loan

The first benefit of using the Marcus loan is the flexible payment schedule. The second is a 0.25-0.5% discount provided by the auto payments.

In addition to these two, I was also happy to find that I can skip a month of payments by making payments on time for 12 months in a row.

Another innovative feature is the ability to make a direct payment towards a credit card lender or another fintech company.

Keep in mind that the maximum number of credit cards is set at 10. Also, Marcus offers friendly fees and a reasonable APR for people with a credit score of 660 and above.

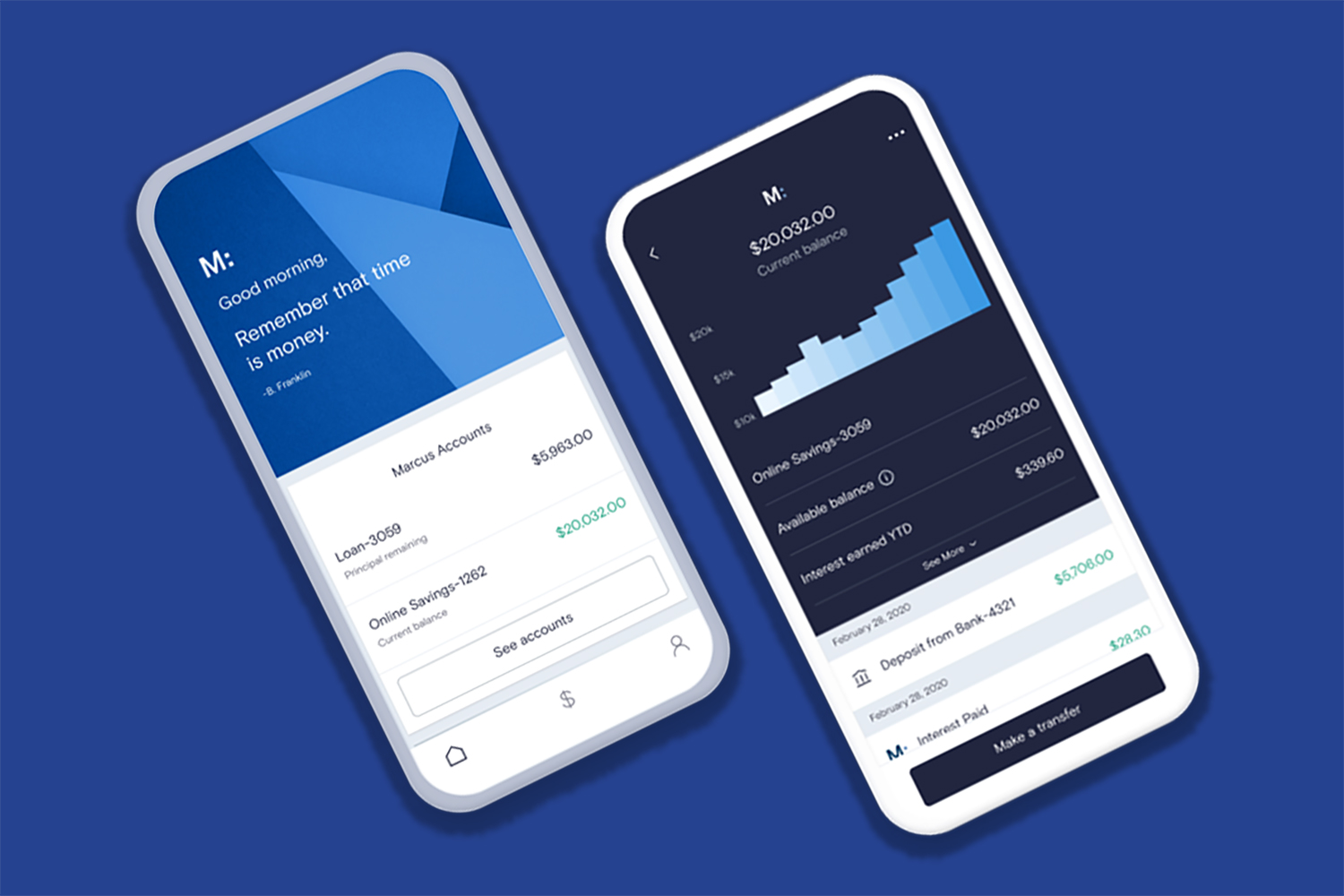

Intuitive Marcus App

Last but certainly not least is the intuitive app available for iOS and Android devices.

Apart from monitoring the loan, I was able to learn more about increasing my FICO score and make sure to make the monthly payments on time.

Drawbacks of Marcus Loans

All personal loans and credit cards come with certain drawbacks. The main downside of Marcus Loan is the fact that I couldn’t get a joint application.

By prohibiting co-applicants and co-signers, the fintech company leaves no room for collateral or getting approved for a loan sum that is higher than $40,000.

In addition to that, I wasn’t impressed with the customer service that Marcus offers.

Yes, there is an extensive FAQs page and a telephone line available 7 days a week, but I was able to reach an operator only two times out of five tries.

No Chat Service

In my opinion, it would be much better if Marcus invested in online customer support that will be available 24/7, 365 days a year.

The main reason is that the chat service allows fast responses and covers the fact that Marcus by Goldman Sachs doesn’t have a physical location.

How Does Marcus Compare to Other Personal Loans?

One of the biggest competitors is SoFi which has a few advantages over Marcus Personal Loans.

The first one is that it offers higher loan sums set anywhere between $5,000 and $100,000. In addition to that, an even more flexible payment schedule for a period of 24 to 84 months.

Another cool fintech company is LightStream which I consider to be a better option if you have a FICO score below 710.

The maximum loan amount is set at $100,000, and the highest APR is around 20% which is pretty great for a personal loan.

Marcus vs. Upgrade

Last but certainly not least is Upgrade which is probably the most similar to Marcus.

Although it does feature an origination fee and a higher APR, this fintech company approves people with credit scores as low as 580.

Also, it offers friendly terms and a maximum loan sum of $50,000.

Marcus Contact Details

As I’ve mentioned, Marcus by Goldman Sachs doesn’t have a physical location.

Still, they do offer a couple of telephone lines, of which the one for lending is open 8 am – 10 pm from Monday to Friday and 9 am – 7 pm from Saturday to Sunday.

The number that I called is 1-844-627-2871.

Also, there is an extensive FAQs page that addresses most of the common questions and issues that you may encounter while applying for a loan.

No Online Support

The downside is that unlike some other fintech companies, including Upgrade and SoFi, Marcus by Goldman Sachs doesn’t offer a variety of contact forms.

Thus, I wasn’t able to find an active email address, customer support social media account, or a live chat service.

Summary

Judging by my experience, Marcus Personal Loans are a fantastic choice for anyone who has a credit score above 660 and doesn’t need more than $40,000. It offers friendly terms, zero hidden fees, and while the customer support isn’t the best, there aren’t any major issues with this financing option!

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.